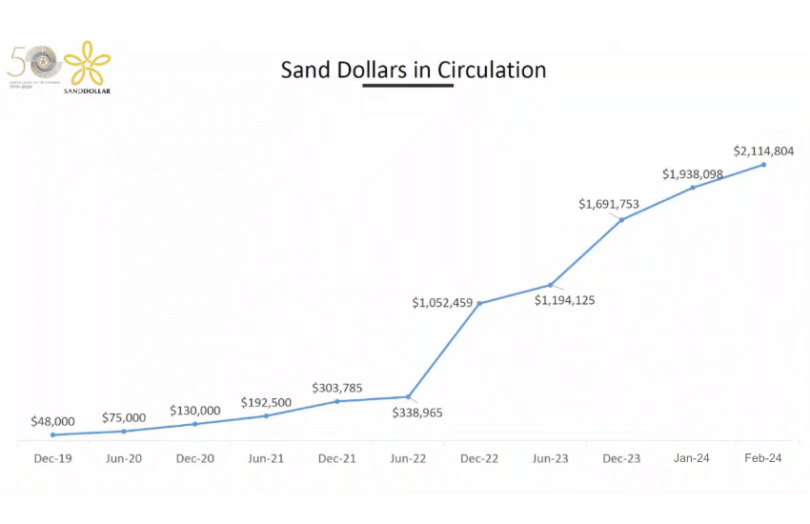

Last week Shaqueno Porter of the Central Bank of Bahamas provided an update on the progress of the Sand Dollar central bank digital currency (CBDC). He was talking during the Digital Euro Conference. After launching the Sand Dollar in late 2020, Mr Porter revealed that the current amount in circulation is $2.1 million, representing less than 0.5% of cash in circulation. (The Bahamian dollar is pegged to the U.S. dollar.)

The number of Sand Dollar wallets looks more positive at 120,000 out of a population of just over 400,000. However, tourists can also download the wallet, and last year the islands received almost six million visitors in the first seven months alone. There’s no need for KYC for small transaction levels in Tier 1 of the Sand Dollar, making tourist adoption easier.

Stepping back, emerging economies and particularly Caribbean islands, have different motivations from advanced economies. Hurricanes frequently strike the Bahamas, knocking out banks. Hence, there is a desire to create an alternative system to reduce reliance on banks during such events.

Additionally, bank branches are retrenching worldwide, but also on less populated islands in the Bahamas. That makes access to cash very tricky, with people sometimes having to travel long distances. However, the rollout of the Sand Dollar has encountered internet infrastructure issues on several islands. Hence, the central bank is currently working on an offline CBDC.

CBDC challenges

This was one of four challenges identified by Mr Porter. Consumers were confused about multiple proprietary wallets, so education was needed to demonstrate that the Sand Dollar works the same in them all.

Another challenge was educating the public on where they can top up. For example, there are numerous automatic kiosks where people slot in cash, which shows up in the wallet. Plus, users can top up with merchants or via bank accounts.

The number of merchants that have adopted the digital currency remains a key focus of the central bank. It’s been running promotions and giving rebates at various supermarket chains. So far 1,800 merchants have signed up.

Mr Porter opened with a story about taxi drivers who only accept cash. When they start using the Sand Dollar, they have a log of their takings and hence can get a loan.

A member of the audience asked whether users are wary of the CBDC. That potentially applies as much to merchants as it does to end users. The informal economy is estimated to be just under a third of the Bahamas’ GDP. It’s not an issue Mr Porter addressed, but perhaps some merchants don’t want a digital footprint.

Regarding fears, Mr Porter addressed the privacy issue, saying that only the banks and PSPs have the end user’s identity. The central bank will only become aware of it if there is an investigation for money laundering or criminal activity.

Another potential avenue of adoption is government services. The central bank worked on that back in 2021, but there was subsequently a new government. Hence, the central bank started again with government engagement and hopes to progress in that area.