Bain and Company released a report about disruption in transactional banking. The report predicts that distributed ledger technology (DLT) could reduce trade finance operating costs by 50 percent to 80 percent. Additionally, they estimate three to four-fold improvements in execution times.

Appeal of transactional banking

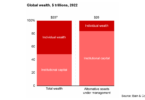

While global banks like Citigroup, HSBC, and JP Morgan have focused on the sector for years, others are now entering. Bain point to the stability of income and the lower-cost deposits which help banks liquidity ratios. Also, there’s the potential to cross-sell other products. But most of all there’s the high return with HSBC expecting transaction banking to return 20% on tangible equity.

Competition in trade finance

Apart from all the blockchain consortia, there’s already significant new competition. Supply chain platforms like Tradeshift and PrimeRevenue are examples. However, Bain doesn’t mention that banks also integrate with these platforms.

Bain mentioned the two blockchain consortia: we.trade the nine bank consortium supported by IBM, and Marco Polo the R3 TradeIX project. But there are two more consortia: A five bank one called Batavia and a twelve bank R3 consortia focused on Letters of Credit.

In e-commerce, Alibaba and Amazon are already lending to small firms. For example, Amazon is lending more than $1 billion a year.

Bain estimates that DLT if done correctly, has the potential to reduce trade finance operating costs by 50 percent to 80 percent. Plus they estimate a time savings of eighty percent for processing a letter of credit, which is the focus of the Voltron project. But this will also result in a decline in prices.

Rethinking the role of a bank

The consultancy talks about Ripple’s impact on cross-border payments. Plus they mention the role of DLT in the settlement and clearing of securities.

The conclusion is there’s a wave of pricing pressure coming, and banks need to adapt. One suggestion they make is for banks to change the way they charge. Instead of charging per transaction, to charge a fee for a package of solutions. For example, the solution might include transactions, analytics, security features, and access to web portals.

The report concludes by exploring the different ways that banks could position themselves.