we.trade is a trade finance blockchain application owned by nine banks. The platform’s launch in the coming weeks will be a genuine milestone in enterprise blockchain as the first significant trade consortium to go into production.

While other projects are live, such as Finastra and EY/Maersk insurance, they don’t involve a consortium of competitors.

One of the most interesting aspects is what’s involved in getting a project from pilot to production. That’s explored below.

Why we.trade?

Belgian bank KBC was the project instigator. The story goes that the head of trade finance, Hubert Benoot, had a chat with a friend who is a potato farmer. When asked why he didn’t export his produce outside of Belgium, the farmer said it was too risky. He was concerned about getting paid and didn’t know how to find out enough about the buyer to address his fears.

Hence the seed of an idea which resulted in a 2016 proof of concept (PoC) called the Digital Trade Chain, and eventually we.trade. Below is a video of the PoC.

It’s also worth noting that existing trade finance like Letters of Credit address these issues but are incredibly inefficient. Because they’re so complicated and costly, most SMEs don’t use them, or indeed don’t have access to them, plus they’re less widely used in Europe. Hence we.trade does not cover Letters of Credit.

What is we.trade?

we.trade is a digital platform that initially targets SME to SME trade within Europe. It directly addresses the exporter’s risk of cross-border trade, enables financing, and allows them to monitor the transaction. Digitizing on we.trade is intended to make financing simpler, cheaper, and faster.

The only snag when it launches is both the exporter and buyer need to bank with one of the nine founding shareholders. As the pool of banks expands, it should have a network effect. So the participants in a we.trade transaction are the buyer, buyer’s bank, seller, seller’s bank and transporter.

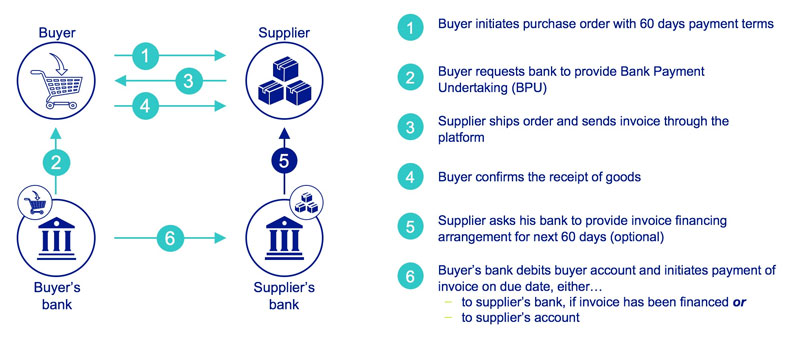

The importer raises a Purchase Order on the platform, and they have an option of taking out a ‘Bank Payment Undertaking’ which is essentially a guarantee of payment by the importer’s bank to the exporter. On top of that, the exporter can get early invoice payment if they select financing from the exporter’s bank.

The financing options are factoring or forfaiting, which are termed ‘open account’ in the industry. In the case of factoring, the exporter receives a large percentage of the billed amount at the point of invoicing. But there’s still some payment risk for the remaining balance. Alternatively, with forfaiting, they can choose to sell the full invoice at a discount to the bank. In the latter case, if it turns out the buyer has insufficient funds, it’s not the exporter’s problem.

All parties can track the shipment in transit. Plus with we.trade you don’t have to chase for payment. Invoice settlement is automatically triggered by smart contracts, though payments go via SWIFT, not a blockchain.

The platform includes some non-blockchain elements including a directory function. Here customers can find potential trading partners and socially score them in a similar way to Amazon or eBay.

Creating a business

The original consortium banks were Rabobank, Deutsche Bank, HSBC, KBC, Natixis, Societé Generale and UniCredit. Later Nordea and Santander joined. And more recently the consortium incorporated as a joint venture in Ireland, with Roberto Mancone transitioning from Deutsche bank to take up his role as Chief Operating Officer.

Joshua Kroeker heads up Blockchain and DLT for trade finance at HSBC. He told Ledger Insights: “You need to have a place where the IP sits. A central place that on boards new participants etc. And to keep it truly decentralized you need to make sure that’s a neutral party.”

Kroeker continued: “The fact that they have created this new entity I think is really fantastic and it really shouldn’t be undersold. The fact that you can get nine banks to come together and agree on that, it’s actually a big achievement.”

The on-boarding refers to new banks because the SMEs gain access through their banking relationships. Because of the potential for a network effect of clients attracting other clients, the group is very keen to encourage new banks to join as SaaS licensees. Additional banks will have precisely the same software as the founding shareholders.

Keith Bear, VP of Financial Markets at IBM, articulated the importance of attracting more banks: “The ones that will be successful are where we see a large group or groupings of banks that give a critical mass to a network and are able to commit the clients, are able to commit the transaction flow to the network to make it commercially viable.”

However, it’s one thing to have more banks using the platform, and it’s another to add more shareholders. There isn’t a big appetite for adding more shareholders or decisionmakers because of the need to move quickly.

Technology

In the second quarter of 2017, the consortium selected IBM as the technology partner. The blockchain uses Hyperledger Fabric, and each bank has their own node (server) which can either be in IBM’s cloud or on premises.

Fabric has the concept of channels so that only the parties to a channel or set of transactions get to see all their data. So for a particular buyer-seller relationship, just those two parties and their banks will be able to view their transactions. Hence, banks don’t get to see each other’s clients in bulk. The financing and payment process is managed using Smart Contracts.

Pilot to production

There are three main aspects to getting ready for production. The first is building the platform. The initial version is essentially complete for we.trade.

The second aspect is the commercial side which includes the creation of the joint venture and the commercial model. This involves everything a startup would need to do, including finding premises, staffing up, marketing, support, and the like.

The third aspect is the operating model for an in-production blockchain consortium project. This is virgin territory. There is no case study or example to follow.

IBM’s Keith Bear elaborated: “You have a significant number of banks associated, all with their own views on how this should be done, their own internal standards on compliance, security, their own change management processes. So to be able to consolidate into a single rulebook and a single operating model for the network is quite a challenge.”

Additionally, all the banks and the platform have to comply with regulatory responsibilities, plus one of the trickiest issues of all is upgrading smart contracts on a live system.

Smart contract upgrades

If you upgrade a normal piece of software with just one company involved, that’s pretty painful. With a blockchain, they will have to coordinate nine banks to do it at the same time. That’s how it works – each bank’s node or server has a copy of the code, and they need to have the same version. Now consider if there are hundreds of banks.

But that’s not the only tricky part. Blockchains aren’t like other pieces of software where you can update the code at will. They’re designed to have infrequent changes precisely because of the painfulness described above.

What if you have thousands of open invoices on smart contract version one, and now you are introducing smart contract version two? It turns out there are ways to deal with this versioning of smart contracts, but like everything else they are somewhat new and only tried in proofs of concept.

However, IBM has put operational processes in place so there will be minimal impact on the platform usage when an upgrade is needed.

Next steps

As yet there’s no announcement of a launch date but at a recent conference member banks confirmed the timing is weeks not months.

Once the platform is up and running and stable, the next step will be adding more banks and more features. SMEs are just the beginning.

Blockchain and trade finance is already a crowded space. There are at least three other significant consortia not yet ready to go live, apart from country-centric ones like India and Hong Kong. There are also rumors about a merger.

Plus there are many startups and multiple specialist platforms like Tradeshift and Dianrong starting to offer blockchain driven services. Additionally, there are numerous broader supply chain projects like IBM/Maersk which have the potential to overlap.

It’s a race, and the starting gun will be fired in a matter of weeks.

Update: we.trade is live.