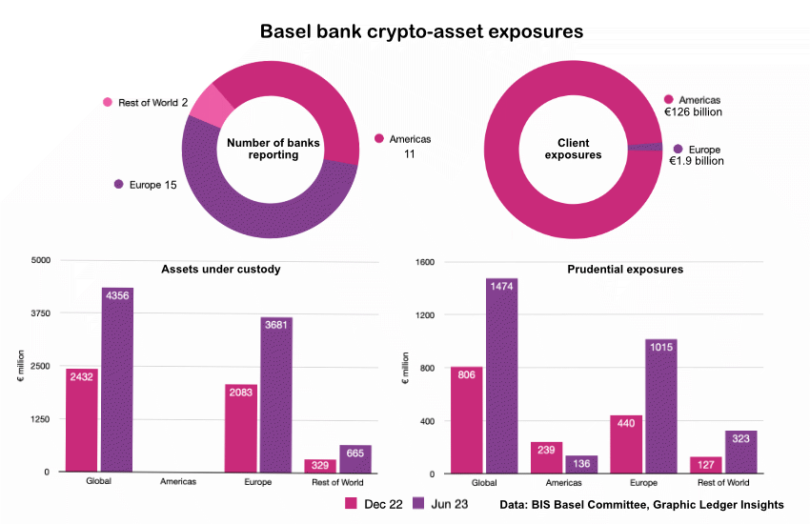

Today the Basel Committee on Banking Supervision (BCBS) published the latest Basel III monitoring report, which gathered data on 177 banks globally. Just 28 banks disclosed crypto-asset exposures for the six months to June 30, 2023. Digital asset custody figures rose 79% to €4.4 billion across all banks. However, comparatives may not be reliable.

American banks are largely absent from the custody sector, with just €11 million under custody across 11 banks. This can be primarily attributed to the SEC accounting rule (SAB 121) that makes it prohibitive for U.S. banks to provide digital asset custody.

European banks dominate digital asset custody with €3.7 billion held in custody, almost all spot cryptocurrencies. Two banks in the ‘rest of the world’ provide custody for €665 million, also for spot crypto.

Digital asset exposures

Regarding prudential exposures — i.e., banks holding crypto or tokenized securities on their balance sheets — the figures total €1.5 billion across all banks globally. Two-thirds of that is in Europe, with most of it in spot crypto, followed by tokenized assets.

The BIS figures also disclose ‘other’ exposures, which mainly relate to services provided on behalf of clients. Globally, this figure increased from €91.5 billion at the end of 2022 to €128 billion mid-2023. However, there were four more banks in the 2023 sample, so it is conceivable that the increase could represent more banks reporting.

There is also a big geographic divide here. Banks in the Americas provided €126 billion of the €128 billion in client-related service exposures. While Europe’s €2 billion was mainly spot crypto, in the Americas, the figures are dominated by exchange-traded products. And that was long before the launch of the spot Bitcoin ETFs.

Previous reports are available for Dec 22, June 22, and Dec 21. However, there will be inconsistencies between them owing to measurement changes and the make up of banks providing statistics.