Today MUFG’s Trust arm announced a joint study with Binance Japan to explore the crypto exchange issuing public blockchain stablecoins in Japanese Yen and other currencies. MUFG founded the Progmat blockchain tokenization platform, which also includes the Progmat Coin stablecoin platform. Progmat is now jointly owned by other firms such as Japan’s second and third largest banks SMBC and Mizuho.

In addition to issuing multiple currency stablecoins, the stablecoins will not be restricted to Japanese users. Hence Japan could become Binance’s stablecoin issuance base. In February, the New York State Department of Financial Services (NYDFS) instructed Paxos Trust to stop issuing the Binance USD (BUSD) coin. The expected launch date of the Japanese Binance stablecoins is 2024, subject to Binance Japan’s receipt of an Electronic Settlement Methods Transaction Business Provider license.

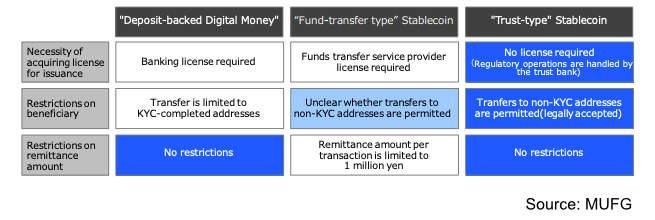

In June, Japanese legislation came into force supporting different types of stablecoins, including bank issued and trust issued. Where the stablecoin is issued by a trust such as Mitsubishi UFJ Trust, it allows non licensed issuers, and no KYC is required for stablecoin transfers. Additionally, the reserve assets are ringfenced. This is similar to the Paxos Trust solution.

The core Progmat blockchain technology is based on the Corda enterprise blockchain. However, MUFG has been working with DataChain and TOKI technology to issue stablecoins on multiple public blockchains and enable cross chain transfers. The initial plan was Ethereum, followed by Cosmos, Polygon, Avalanche and others. The question is whether this announcement will raise the priority of Binance’s BNB Chain.

“We believe that the new stablecoin from this collaboration will be a step forward in advancing the Web 3.0. Progmat is a neutral infrastructure that enables the issuance of various brands of stablecoins with the greatest flexibility of use and the least risk of de-pegging, it does not compete with players issuing their own stablecoins,” said Tatsuya Saito, Founder and CEO of Progmat.

“We have already announced the other stablecoin project with several Japanese financial institutions as joint issuance applicants, and we are working with several other partners equally on deals in addition to this announced initiative. Among them, Binance has a strong position in the existing crypto assets trading world, and the impact of having the most secure stablecoin functioning within this ecosystem is immeasurable. Stay tuned for further announcements.”

In November 2022, Binance Japan acquired an existing crypto exchange, and changed its name to Binance Japan last month. It currently has 34 tokens listed, which is a lot for a Japanese exchange.

Analysis: A big win for Binance, Progmat

From Binance’s perspective, this is potentially a massive win. Since the loss of its own stablecoin, it has been promoting little known stablecoins on its exchange by dropping transaction costs. That’s a potentially risky move. In contrast, the MUFG relationship will be of higher quality than the Paxos one, which was already very decent.

After all, the brand of a global systemically important bank such a MUFG standing behind the issuer is a big deal. Not just for Binance but for stablecoins generally. It moves stablecoins into a different realm of credibility.

For Progmat it is also a huge win. The market capitalization of Binance’s BUSD stablecoin was $16 billion before the NYDFS order to cease. So any stablecoin is likely to be significant.

However, the deal presents multiple risks, four in particular.

Analysis: reputational risks

Firstly, in the United States, the SEC and CFTC have sued Binance. And there have been reports that the Department of Justice might also launched a criminal prosecution against the cryptocurrency exchange.

However, should things go south, any stablecoin will be safely backed by reserve assets. So there is no risk of loss of money to consumers.

However, there are significant risks. Firstly, there is reputational risk. It would be different if this were mid-2022, before the collapse of FTX and the start of the lawsuits. One can’t claim ignorance or a lack of awareness of the significant risks. In Singapore, government-backed Temasek invested in FTX and suffered considerable blowback.

But MUFG is a global systemically important bank. How much due diligence will be needed to get the go ahead for this to prevent tarnishing MUFG’s reputation?

Analysis: financial stability, TradFi risks

Secondly, compared to other jurisdictions, Japanese stablecoins are likely to include a higher proportion of bank deposits. We understand that all bank deposits are insured in Japan. There is no limit. Hence, if Binance had an FTX-style event, there could be a run on the stablecoin. That would translate to a run on bank deposits of multiple banks.

Theoretically, this should not threaten banks precisely because of the blanket government insurance. (Correction: Japan fully insures only non interest bearing deposits excluding foreign currencies. Hence this conclusion may not be accurate.) But given social media and how quickly things move nowadays, that remains to be seen. If the test doesn’t work, it could result in the Japanese taxpayer bailing out banks. That really seems like an edge case scenario, but they happen.

However, that leads on to a third regulatory risk. Global regulators have banged the drum about separating the crypto world from the traditional finance (TradFi) world. Today it’s hard to think of a tighter linkage than an MUFG Trust / Binance deal. It’s the trust arm of a global systemically important bank and the largest crypto exchange. And an exchange with multiple dark clouds hovering above it. Will global regulators pressure Japan?

We also don’t yet know the full details of why the NYDFS stopped the BUSD issuance. It could have been because of alleged AML breaches. Perhaps they wanted to prevent a potential run following the announcement of lawsuits. Or, perhaps it related to wrapped stablecoins, the fourth risk.

Analysis: will wrapped tokens be allowed?

With BUSD, Paxos only issued stablecoins on Ethereum. Binance would lock an amount on Ethereum and issue wrapped stablecoins on other chains, such as BNB. For a period there was a mismatch and the wrapped stablecoins were not fully backed. Binance attributed it to an administrative snafu.

The point is that wrapping tokens overrides the control of the issuer. In the U.S. it was Paxos. In Japan it will be MUFG’s Trust arm. This creates consumer risk because users may be unaware of the wrapping. And it creates additional reputational risk for the trust issuer. Paxos lost the EDX Market’s custody deal, which may have been related to the BUSD saga.

While there are plans for Progmat to support multiple blockchains, if it doesn’t roll out quickly enough, Binance will do the wrapping itself. However, that depends on whether MUFG Trust allows cross chain wrapping in its terms and conditions.

Despite exploring the risks, high quality stablecoins are highly desirable. They create the foundation to use stablecoins in the real world. It is a major potential path to enable cheaper, faster cross border payments.

Update: we added the analysis sections. Additionally a clarification that only yen non-interest bearing deposits are fully covered by deposit insurance.