Today Japan’s largest bank MUFG announced that its Progmat Coin solution would be used to issue native bank-backed stablecoins on multiple public blockchains, including Ethereum, Avalanche, Cosmos and Polygon. The work is at an early stage, so the timeframe for the launch was not confirmed.

Progmat Coin is designed to support stablecoin issuance from various trust banks, not just MUFG. Yesterday new enabling legislation came into force, allowing Japanese trust banks to issue stablecoins.

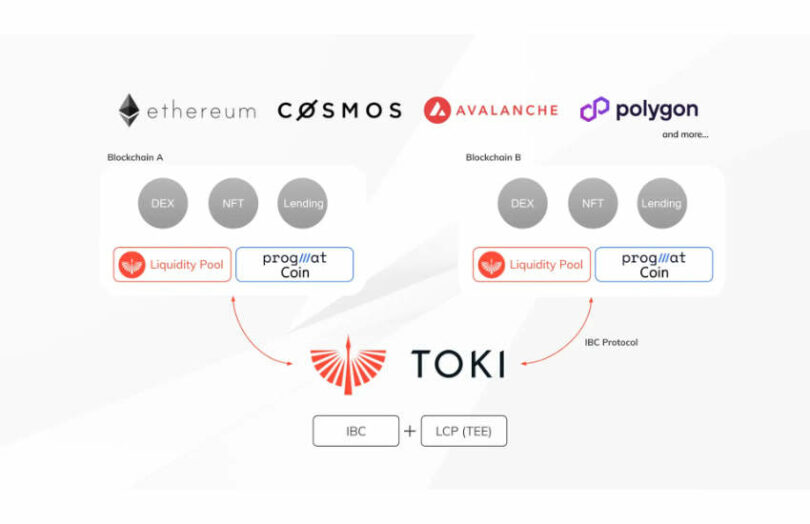

We previously reported that MUFG was working with blockchain interoperability startup DataChain. It is also collaborating with TOKI, a cross chain bridge solution for public blockchains based on DataChain’s technology. The aim is to support public blockchain cross chain swaps, cross chain payments and cross chain lending. For example, the purchase of an NFT could be settled with a Progmat Coin on a different blockchain.

TOKI will enable this by running liquidity pools with Progmat Coins on multiple blockchains. TOKI was established in March this year in Dubai by a DataChain executive and plans to launch its bridge later this year and issue its own crypto token.

We believe the solution is primarily focused on the Japanese market and have asked whether users will need to go through know your customer compliance to hold the stablecoins.

Progmat also does security tokens

The Progmat platform also supports security and utility tokens, with some of these potentially involving cross bridges in a similar manner. Numerous security tokens have already been issued. MUFG founded Progmat, but the platform is morphing into a joint venture with backing from the country’s main stock exchange operator JPX, Mizuho, SMBC, SBI and others.

Progmat’s core platform uses R3’s Corda enterprise blockchain. Datachain’s technology is based on Cosmos’ IBC, and the core has been open sourced as the Hyperledger YUI Lab. It has also collaborated with JCB, Japan’s card equivalent of Visa.

Meanwhile, the first systemic bank to issue a stablecoin on a public blockchain was Societe Generale with its EUR CoinVertible in April. Apart from the initial EUR 10 million issuance, there have been no transactions so far. Brazilian investment bank BTG Pactual launched a US Dollar stablecoin earlier that month.