Today the Bank for International Settlements (BIS) the central banker’s bank, published a report about Central Bank Digital Currency (CBDC). The conclusion is to proceed with caution and shows that while the majority are researching CBDCs, only a small number plan to issue one in the short to medium term.

The BIS defines a CBDC based on four characteristics. A central bank issues it, and it’s digital, not physical. But it’s also conceivable to have general purpose central bank accounts which aren’t tokenized (account-based). If the digital money is tokenized, then there are two potential types: “wholesale” for financial institutions only, and “general purpose” CDBCs which the BIS refers to as “digital cash”.

Sixty-three banks responded to a BIS survey covering 80% of the world’s population and 90% of economic output.

70% of banks are engaged in or about to start CBDC work and of these more than half are exploring both general purpose and wholesale CBDCs. Many are using distributed ledger technology (DLT) to replicate wholesale payment systems. When combining the BIS figures, 48% of respondents are exploring wholesale CBDCs and 61% are exploring general purpose CBDCs.

Two months ago OMFIF and IBM published a report stating 38% of the 21 central banks surveyed were exploring wholesale CBDCs.

Only five projects have advanced to the pilot phase, but the BIS emphasizes that most proofs of concept (PoCs) and pilots are still investigative and don’t imply concrete plans for implementation.

Motivations

The primary motivations are payments safety and domestic efficiency. The lowest priority benefits are financial inclusion for wholesale CBDCs and cross-border payments efficiency for general purpose CBDCs. That’s although two sets of Central banks have worked on joint projects: Project Stella by the ECB and Bank of Japan, and a joint project by the Bank of Canada, Monetary Authority of Singapore, and Bank of England.

In the case of general purpose CBDCs, for emerging market banks, domestic efficiency and financial inclusion were most important. For advanced economies, the emphasis was on safety and financial stability with financial inclusion the least important.

Any time soon?

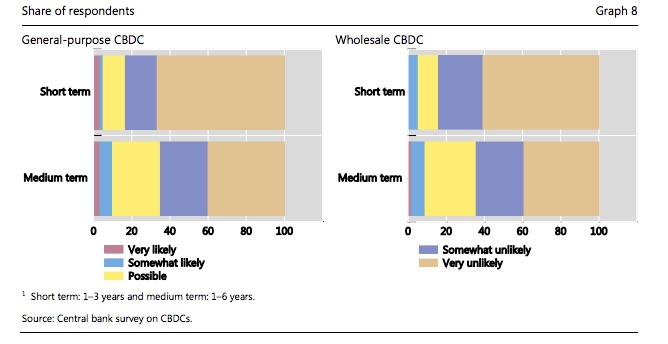

The BIS didn’t split out the results for the likelihood of launch between emerging and advanced economies. While the “very likely” figure was small, there are clearly some considering a general-purpose CBDC in the short term (1-3 years) and a few more in the medium term (1-6 years). No banks gave a strong likelihood of a wholesale CBDC in the short term, with a tiny number in the medium term. Less than 25% said that current laws allow CBDCs or will do so soon.

Caution and collaboration seem to be the central bank approach, and the BIS is optimistic that this perspective could head off unintended consequences.