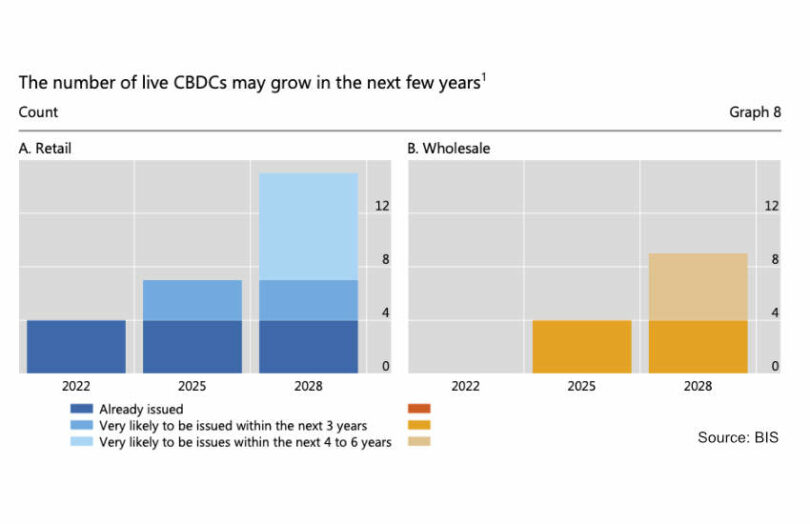

The results of the 2022 BIS survey on central bank digital currencies (CBDCs) came out today. Based on current progress, the BIS says we could see another 15 retail and nine wholesale CBDCs by the end of the decade.

According to the study, the share of central banks actively exploring a CBDC grew from ninety percent in 2021 to 93% in 2022, with more progress made in retail experiments. The survey represents 94% of global economic output and suggests that emerging markets are leading the race, as advanced economies lag behind in both retail and wholesale CBDC pilots.

The questions explored the current stage of development and motivations for potentially issuing a CBDC, finding that almost sixty percent have accelerated their research in response to the rise of cryptoassets and stablecoins.

Retail versus wholesale CBDC

In general, the survey suggests that work on retail CBDCs is more advanced. The number of central banks piloting a retail option is double the amount running a wholesale trial in which users are limited to banks. The share of monetary authorities expecting to issue a retail CBDC in the next three years is 18%. Still, sixty-eight percent say they are unlikely to issue one in the near term.

The study shows that central banks think wholesale CBDCs could help alleviate major bottlenecks in cross-border payments, including “the limited operating hours of current payment systems, the length of existing transaction chains, and the complex processing of compliance checks.” Project Dunbar, which the BIS Innovation Hub ran together with four central banks in 2022, demonstrated the potential of multi-CBDC platforms to deliver cheaper, faster and safer cross-border payments.

Emerging markets vs. advanced economies

Twenty-eight advanced economies responded to the survey and 58 emerging markets. The study revealed differences between the groups. For one, all the current live CBDCs have been issued by developing countries (Bahamas, Eastern Caribbean, Jamaica, and Nigeria). But also, the share of emerging-market-central banks piloting a retail (29%) and wholesale (16%) CBDC is much higher than those of advanced economies (18% and 10%, respectively).

CBDC coexistence with fast payments

On a final note, one interesting finding is that four in five central banks agree that CBDCs should coexist with fast payment systems (FPS). This is because CBDCs offer additional functionalities, such as programmable features and offline payments.