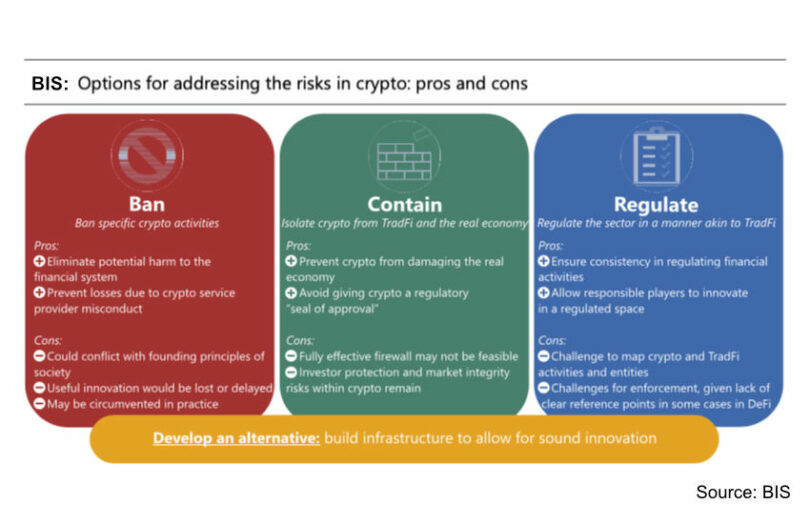

The Bank for International Settlements (BIS) published a brief paper exploring the options to address the risk of cryptocurrencies, or as it likes to call them, crypto-assets.

It argues that cryptocurrencies feature many of the risks of TradFi, but while similar, the risks tend to be exaggerated. These include the extensive use of leverage, liquidity and maturity mismatches, and significant asymmetries in information.

We’d add an observation on the maturity mismatches. For example, crypto lenders have deposits that can be instantly withdrawn but extend loans to borrowers for months or years. TradFi may have similar mismatches. However, because cryptocurrency is networked, including at the social/Twitter level, ‘bank runs’ and herd movements are far more frequent, exaggerating the problematic nature of the maturity mismatches.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.