Today the BIS unveiled Project Rialto a new foreign exchange (FX) module looking to improve FX settlement for instant cross border payments. It will use wholesale central bank digital currencies (wholesale CBDC) as the settlement asset. The FX module could be used as an add on for solutions that interlink instant payment solutions, such as Project Nexus, or as part of a digital asset settlement solution.

Rialto is a collaboration between the BIS Innovation Hubs in Singapore and the Eurosystem. They haven’t yet shared which central banks are involved.

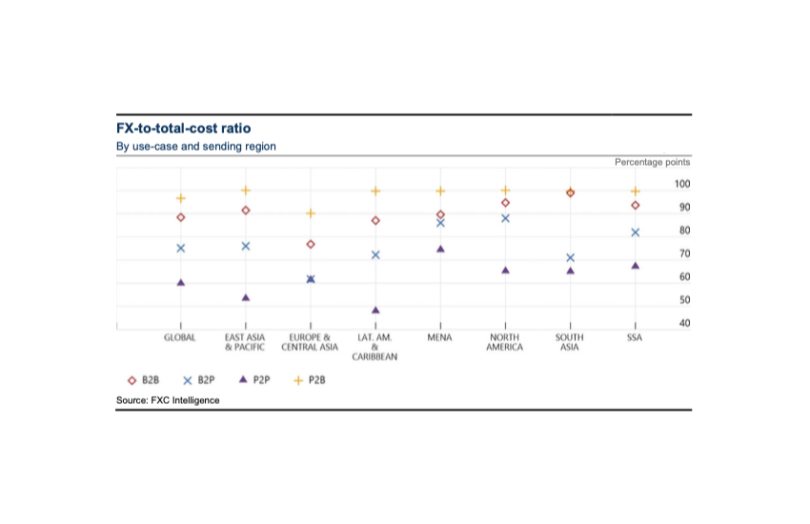

Given the G20 initiative to make cross-border payments cheaper and faster, the focus on FX is essential, given that it is the largest component of costs. As highlighted by the Financial Stability Board, FX accounts for 60% of P2P payment costs globally and as high as 97% of P2B payments.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.