During February’s first public speech as White House Crypto czar, David Sacks said that stablecoins could increase demand for Treasuries and lower interest rates. Now new research from the Bank for International Settlements (BIS), often called the central bank of central banks, supports this theory, except that the primary impact is on short versus long term rates, given that stablecoins invest in short term Treasuries.

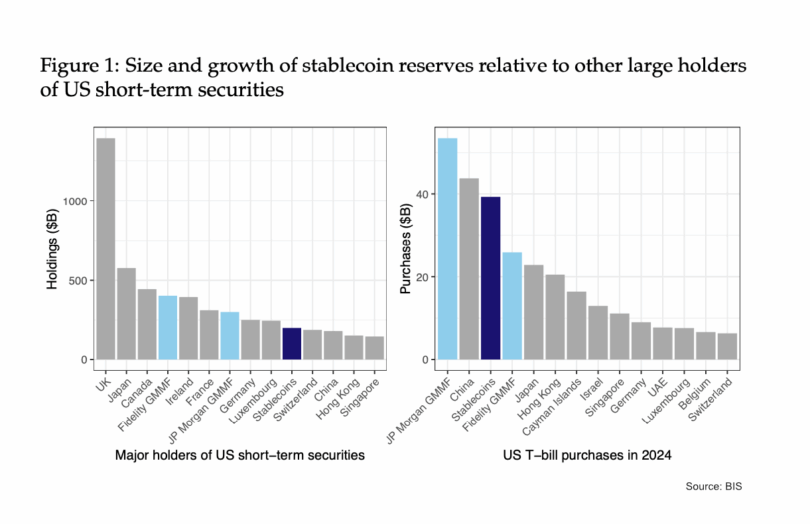

The BIS report reveals striking statistics about stablecoin market influence. While stablecoin issuers have been noted as major holders of short term Treasuries, surpassing the holdings of countries such as China, the BIS highlights that during 2024, they were the third largest purchasers of Treasuries bills*. That figure is based on the net increase in stablecoin reserves.

Regarding the impact on Treasury rates, the BIS study notes that a naive analysis of a $3.5 billion change in stablecoin holdings of Treasury bills implies a 25 basis point (0.25%) change in short term Treasury yields. However, it says this significantly overstates the impact, because many factors will simultaneously influence both stablecoin demand and Treasury rates.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.