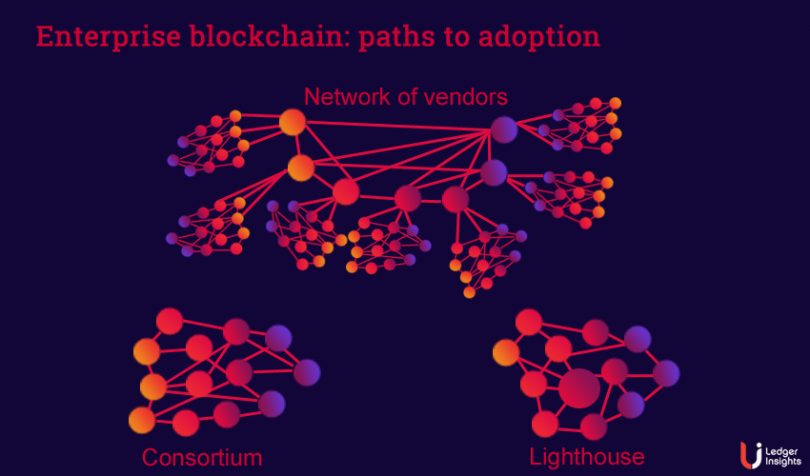

There are two accepted routes to rolling out an enterprise blockchain network. One is to create a consortium, which has proven to be predictably slow. The other is to start with a lighthouse client, build the solution faster, and add other enterprise participants later. Based on what’s happening in the market, a third route of vendor interoperability is emerging.

While many enterprise blockchain networks include one or more technology suppliers, the route explored here focuses on vendors as the primary participant.

This road to market involves aggregating the technology suppliers that serve the industry and enabling their solutions to interoperate while these tech vendors retain their own clients. The advantages are the vendors have many clients, accelerating the blockchain’s reach through a network of networks. And the blockchain network’s primary participants are technology companies making integration exponentially faster.

Two examples are Coadjute in real estate and the Velocity Network in career credentials.

Examples of tech vendor interoperability

In the UK’s Coadjute solution, several CRM platforms serve the 20,000 plus UK real estate agents. But estate agents have little visibility into what’s happening with the lawyers and the progress of a real estate sale. A significant proportion of UK property sales fall through, so the estate agents are desperate for more details. Every deal involves a lawyer on the buy and sell-side, and there are also multiple technology solutions used by those conveyancing legal firms. So if the estate agents can get visibility into the progress that lawyers are making, it’s a big win. Even if the sale fails they can get the property back on the market faster.

Coadjute aims to provide the glue between the different technology providers as a purely backend network. It enables the proverbial single source of truth about the progress of a residential real estate sale. And beyond the estate agents and lawyers, Coadjute will in future add the mortgage brokers, the banks, the insurers and eventually the utility firms that supply the properties.

Turning to the other example, the Velocity Network is about sharing career credentials, such as qualifications and employment history. Numerous vendors provide technology solutions to colleges, universities or professional training firms. On the other side, the individual needs to prove to a future employer that they have a qualification or the appropriate licenses. You have another set of technology firms that provide hiring solutions to corporates or employment screening checks.

Again the Velocity Network is providing the glue. The technology providers to the colleges and training firms create verifiable credentials. Velocity Network provides a consumer app so individuals can use self-sovereign identity to control with whom they share the credentials. And the technology firms providing hiring solutions and pre-employment screening consume those credentials.

The incentives for vendor interoperability to work

The vendor interoperability approach probably won’t work in every sector.

In both the vendor interoperability examples provided, there are many vendors and they serve different parts of the market. If there were greater concentration, it might start to encounter similar issues to the lighthouse approach with competitors concerned about dominant players.

A key feature of these blockchain networks is that they don’t need to be platforms with direct relationships with the end client. In the case of Coadjute, it has committed to remaining in the backend. That’s because several of its participants would be viewed as platforms themselves. If Coadjute had direct relationships with the estate agents or lawyers, it might be perceived as a threat.

In contrast, arguably, Velocity Network is becoming a platform. It’s providing a self-sovereign identity solution to individuals. Most of its participants are technology providers who work for training firms or recruiters but don’t have direct relationships with the individual who is job hunting. However, staffing firm Randstad is a member of the Velocity Network.

Just a couple of months after the Velocity Network was unveiled, several of the largest employment agencies – the ones with that direct consumer relationship such as Kelly, Adecco, Manpower and Randstad – launched another initiative. Is that a coincidence? Or is it a perception that it might become a threat if the Velocity Network takes off, because of its relationship with job hunters?

Not a platform, so not as valuable?

There’s an argument that by targeting incumbent technology networks, that not much changes process-wise. Things may get faster, as in the case of Coadjute. Or there might be an additional feature or two added to the tech suppliers offering.

But we’re not completely convinced that will be the limit to the potential. The existence of integrated networks could throw up new, unanticipated features, at the very least cross-selling opportunities, more likely new business models. In the case of Coadjute, it makes it easier for lawyers or insurers to market to estate agent clients.

There’s a possibility that the benefits to the network operator could also be more limited. If it’s primarily offering efficiency gains versus a fully-fledged platform’s revenue potential, the ROI will be less than a platform. It’s hard to generalize, and the valuation is likely to vary significantly depending on the specific network and industry.

What about a mix?

It’s worth noting that most other types of blockchain networks also involve some vendors. However, this is often a later initiative and vendors are sometimes wary of the blockchain network’s direct client relationships.

Another factor to consider is who runs the vendor interoperability network. On the one hand, an unknown startup may lack credibility. But it might stand a better chance of success because it is not perceived as a threat.

And only time will tell whether the model works. Both Coadjute and the Velocity Network have yet to launch.

The key takeaway is that instead of considering technology vendors as just another participant in your network idea, there’s a possibility they could or should be the focal point. And given the slow and painful launch of many enterprise networks, one of the appeals is getting networks up and running much faster.