Today the Deutsche Börse Group confirmed that in December it made an additional investment in HQLAX which is a blockchain solution targeting the securities lending market. Deutsche Börse first revealed its collaboration with HQLAX in March 2018, and subsequently invested in August of that year. The solution, also called HQLAX , is based on R3’s Corda and uses blockchain to facilitate efficient and high-speed trading of High-Quality Liquid Assets (HQLA). Banks are required by law to hold a certain amount of HQLAs so that they have quality assets which they can sell quickly when needed.

After comprehensive tests, Deutsche Börse has touted the project’s ‘significant progress’. Six banks have apparently started the on-boarding process and will join the platform when it launches. The system is likely to go into production during the first half of 2019. Both the technical development and the legal and regulatory framework are nearing completion.

How it works

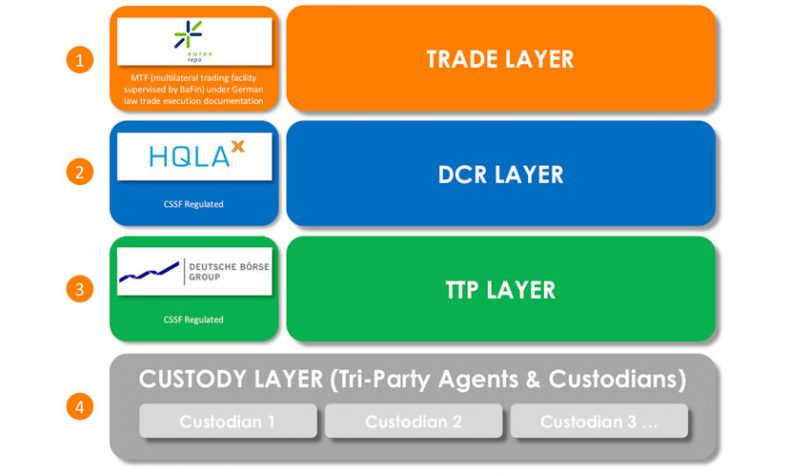

Crucially, no securities will actually change hands on the platform. Instead, tokens that represent the securities will be transferred between parties, while the underlying assets will remain off-blockchain and untouched. The aim is to provide greater efficiency and enable collateral to move been different systems and jurisdictions.

HQLAX is just one aspect of the system. At the trading level, access to the tokens is via the Deutsche Börse’s Eurex Repo trading system. Between HQLAX and the legacy custodian infrastructure is a Deutsche Börse trusted third-party layer.

Clearstream, Deutsche Börse Group’s post-trading services provider, will act as custodian. Deutsche Börse is also in ‘advanced discussions’ with other custodians about their participation.

Jens Hachmeister, in charge of blockchain initiatives across Deutsche Börse Group, comments: “This blockchain use case reveals the significance and potential of the technology. This creates higher liquidity, transparency and efficiency for financial markets in general and securities financing in particular. We look forward to applying DLT for further solutions along the whole value chain.”

Guido Stroemer, CEO of HQLAX, comments: “The interest and commitment shown by the market prove that blockchain can bring tangible benefit to our industry. In Deutsche Börse we found the perfect partner to exploit this potential. The increased shareholdings confirm their strong commitment to our business and the joint solution.”