Last week, the Deutsche Bundesbank unveiled the results of a comprehensive digital euro survey that explored how households might react to the introduction of a central bank digital currency (CBDC). It combined the data with an econometric model to measure disintermediation – the impact of consumers shifting from bank deposits to the digital euro.

The findings, while expected in some aspects, offered nuanced details that added depth to the analysis. While there were many caveats, the work recommended holding limits of €1,500 – €2,500, less than the current expected limit of €3,000.

Only just over a quarter of survey participants had heard of a CBDC, so the basic concept was explained. It’s worth remembering that Germany is a relatively cash-favoring economy compared to others.

While there are no plans for the digital euro to pay interest, the survey asked the question under several scenarios. With zero interest, 45.9% of respondents might use the digital euro. If the CBDC were remunerated at the same rate as bank deposits, the figure was 57.3%, rising to 72.6% if an additional quarter percent were offered. Oddly if it were remunerated at a quarter less than deposit rates, the take up would be 34.4% – ie. less than if it were not remunerated. The paper highlighted that the survey was conducted in April 2023 when interest rates in Germany were considerably lower than currently.

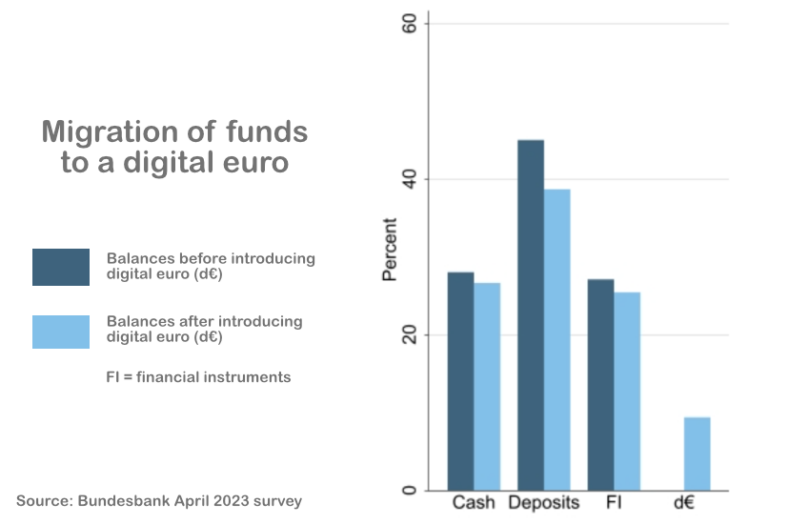

On average, about 10% of money holdings would shift to the digital euro, rising to 21% for the keen group. That includes movements out of cash, bank deposits and other financial instruments, with bank deposits losing the largest slice.

CBDC and trust

The survey also explored trust in the European Central Bank (ECB) and central banks, with the low trust group shifting far less money into the digital euro. “Experience of an authoritarian East German regime is associated with a reduction of approximately 4 percentage points,” the authors observed.

In the case of bank runs, of those who would adopt a zero interest CBDC, 84 percent would withdraw money to a digital euro in a crisis. Even amongst those who would not use the CBDC during normal times, a third would use it during banking stress. However, cash is still the preferred instrument in the case of bank runs, and even more so for the low trust group.

One anomaly identified by the survey was the disinterest from the financially excluded. Three quarters of the unbanked hadn’t heard of a CBDC. The report authors speculated whether the CBDC description provided – a digital bank account with central bank backing – might have deterred them, given their unbanked status. Alternatively they might be suspicious of the ECB. At the other end of the scale, the wealthier respondents are also less interested.

Meanwhile, this is not the first study exploring bank disintermediation for the digital euro. Another was published a year ago. There have been multiple studies on holding limits, including in Europe and Canada.