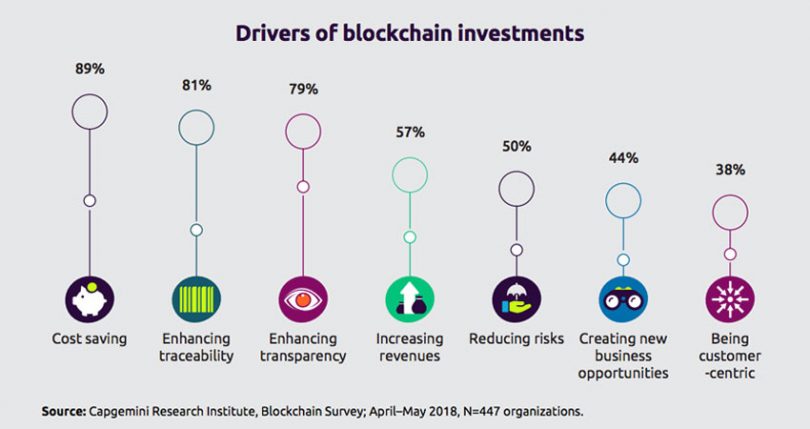

Yesterday Cap Gemini released a report on blockchain for supply chain. The paper includes a decent introduction to blockchain and a survey. The key drivers for supply chain blockchain adoption are cost saving (89%), enhancing traceability (81%) and enhancing transparency (79%).

When looking at barriers to blockchain, a lack of measurable ROI is the number one issue at 70%. But for the organizations that are more advanced in development that proportion rises to 92%.

Adoption barriers

The paper argues that ROI should be reconsidered as the sole criterion of success because of the wider impact such as network effects. The argument is that network effects bring benefits later. Instead it suggests a venture capitalist approach. “The idea would be to make small investments, allow them to rapidly iterate, identify those with potential, and shut down the rest.”

The other barriers in order were:

- immature technology

- regulatory challenges

- lack of complementary systems at partners

- privacy policies

- interoperability with legacy and other systems

- security of transactions

For each of these issues, a more significant proportion of the advanced pacesetters found the topic a challenge.

The security of transactions showed the biggest variance with 82% of pacesetters seeing this as a challenge versus 55% of early experimenters. Another big gap was interoperability: pacesetters: 80%, experimenters: 58%

Manufacturing

Cap Gemini split the survey results from 447 organizations into manufacturing, consumer products, and retail. And they found big differences in preferred use cases between the sectors. The two areas that gain a significant amount of press coverage are shipping logistics and luxury or food provenance tracking.

But it turns out that the manufacturing sector has the highest proportion of projects that are already in production at scale. 6% of projects are live, 8% are in pilot, and 86% are at the proof of concept (PoC) stage.

The most popular uses cases for the industry are supplier contract management, digital thread, production tracking, tracking asset maintenance, and tracking recalled products.

An example of the supplier contract efficiencies is when a proof of delivery from a supplier triggers an automatic quality inspection of materials. If the inspection is satisfactory, a digital payment is triggered.

Foxconn, Apple’s largest electronics contract manufacturer, launched a blockchain-based supply chain finance platform. Called Chained Finance it’s live at scale in China.

Jack Lee, CEO of FnConn, a Foxconn subsidiary, said: “By using the Chained Finance platform, every payment, every supply chain transaction can be more transparent, manageable, and easily authenticated. Chained Finance will provide timely, efficient support to far more suppliers of all sizes. It will also help ensure the timely delivery of products to end customers and improve efficiencies across the entire supply chain.”

Consumer products

In consumer products, there’s the highest proportion of blockchains in pilot phase (15%) with just 2% in production. 83% are still at PoC stage. Tracking provenance is the number one use case. A heavily publicized project is IBM’s Food Trust project that includes Nestle, Unilever, and Tyson.

Cap Gemini state that there’s an estimated €966 billion opportunity for brands that make their sustainability credentials clear.

Keith Weed, Unilever’s CMO said: “Research confirms that sustainability isn’t a nice-to-have for businesses. In fact, it has become an imperative […] they must act quickly to prove their social and environmental credentials and show consumers they can be trusted with the future of the planet and communities, as well as their own bottom lines.”

Other popular applications include tracking critical parameters such as temperature, monitoring asset conditions, regulatory compliance, and product warranties.

Retailers

Retail had the lowest percentage of live (2%) and pilot (7%) projects with 91% of applications still at the PoC phase.

The report claims that the number one opportunity for retail is blockchain-enabled marketplaces. They quote Coupit as an example of a blockchain e-commerce marketplace designed to help verify the reputation of buyers and sellers. With the possible exception of travel sales, this is not an area that Ledger Insights is aware of any current significant activity from incumbents.

By contrast, the second application, blockchain for preventing counterfeit products is very active. Cap Gemini quotes a statistic that counterfeit goods make up 2.5% of global trade amounting to $461 billion.

Chinese e-commerce giant JD.com is using Hyperledger Fabric for its anti-counterfeit solution. They signed up ten brands to participate with their solution shortly after launch.

“Whether to guarantee the safety of food or authenticity of luxury products, consumers want transparency and traceability to be sure they are not being duped with counterfeits,” Haibo Sun, head of blockchain R&D at JD.com told TechInAsia.

One area not mentioned in the report is the numerous diamond applications in both China and the West.