Today a group of PhD candidates published an opinion piece in the Financial Times, arguing that central bank digital currencies (CBDC) might further politicize the role of central banks, which in turn challenges their independence.

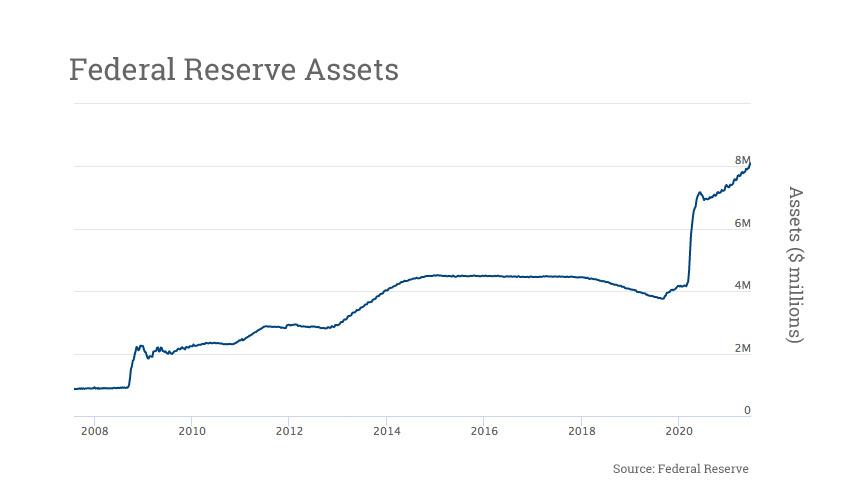

Their logic is that the larger the central bank balance sheet, the more politicized the institution becomes.

They point to the rapid growth in central bank balances sheets that has happened before we even consider a CBDC. Before the 2008 crisis, the European Central Bank’s (ECBs) and Federal Reserve’s assets were €1.5 billion and $0.9 billion, respectively. Those mushroomed to €4.7 billion and $4.2 billion before COVID. And they now stand at €7.9 billion and $8 billion.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.