Today a group of PhD candidates published an opinion piece in the Financial Times, arguing that central bank digital currencies (CBDC) might further politicize the role of central banks, which in turn challenges their independence.

Their logic is that the larger the central bank balance sheet, the more politicized the institution becomes.

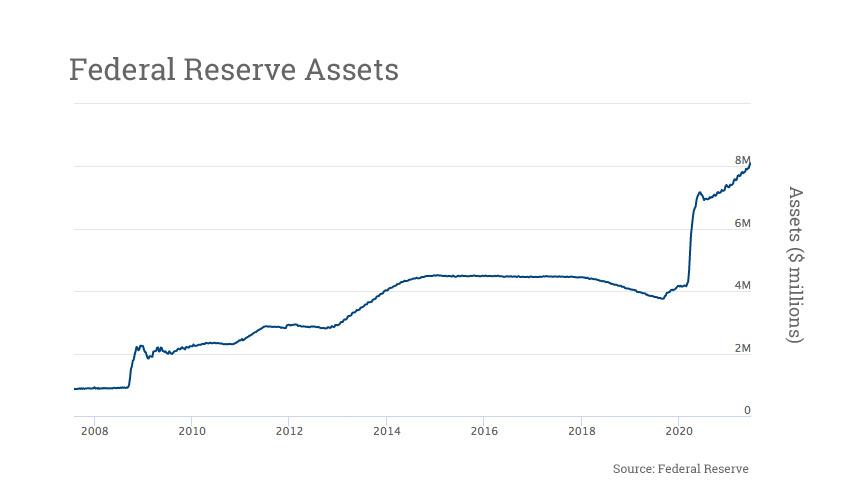

They point to the rapid growth in central bank balances sheets that has happened before we even consider a CBDC. Before the 2008 crisis, the European Central Bank’s (ECBs) and Federal Reserve’s assets were €1.5 billion and $0.9 billion, respectively. Those mushroomed to €4.7 billion and $4.2 billion before COVID. And they now stand at €7.9 billion and $8 billion.

If a CBDC is issued, that will expand their balance sheets even more. For example, if a quarter of U.S. bank deposits switch, that could amount to $4.5 trillion. Morgan Stanley recently estimated that if all EU citizens over the age of 15 moved €3,000 into a CBDC, it would amount to €873 million or an 8% switch.

The trio of academics from the Swiss Finance Institute argues that central banks, which previously might have been considered technocrats, start to look more political. That’s because of the increasing balance sheet size, directly guaranteeing such a large proportion of retail CBDC deposits, combined with targeting climate change. All the authors are Italian, and they also highlight that the former head of the ECB is a politician, Italy’s prime minister Mario Draghi. And former Fed Chair, Janet Yellen is now U.S. Treasury Secretary.

Earlier this year, the same authors published an academic paper. In it, they assume that a CBDC liability to the public will be offset by additional assets. They explore different scenarios of how the central banks might invest those assets, whether in treasuries or riskier securities.

They conclude that if a CBDC is issued, it will be harder to unwind quantitive easing in one scenario. If bank deposits are switched to CBDCs, the banks will likely offset this by reducing their reserves. But lower reserves mean a smaller appetite to buy back assets that the central bank is currently hoarding.

The end result could be semi-permanent quantitive easing.

Another issue they warn of is the potential for negative interest rates. Earlier this week, the Bank of England’s Chief Economist highlighted this as an enormous benefit of CBDCs as a monetary policy tool from a central bank perspective.