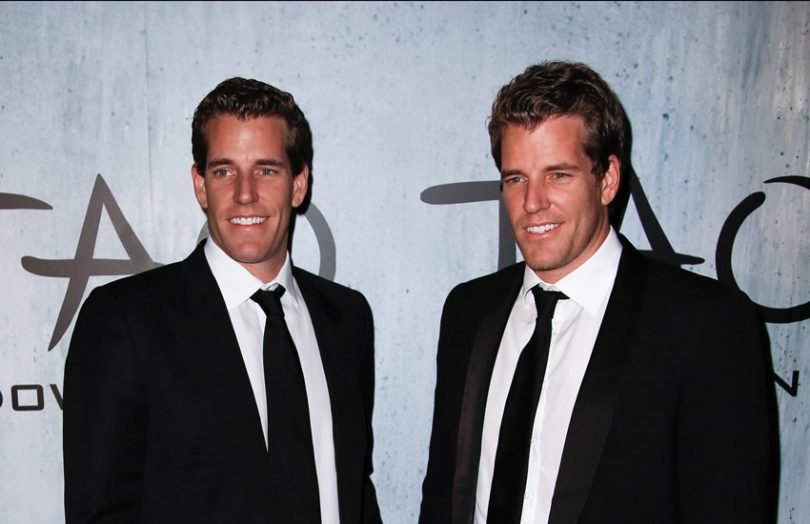

Gemini, the cryptocurrency exchange launched by the Winklevoss twins, has raised its first outside investment in a $400 million funding at a $7.1 billion valuation led by Morgan Creek Digital. Several other organizations participated, including Commonwealth Bank of Australia (CBA) and 10T, a digital asset fund that raised $750 million in October.

Earlier this month, CBA announced it is partnering with Gemini to pilot a cryptocurrency offering to its Australian retail clients.

Apart from the crypto exchange, Gemini currently custodies $30 billion in crypto assets. It also has a cryptocurrency lending product Gemini Earn – the sort that has attracted SEC Chair Gary Gensler’s attention – and has originated $4 billion in loans to date. However, Gemini Trust is more regulated than many other exchanges as a NY Trust company and is a qualified custodian.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.