Highlights

- David Marcus to run both Novi (Calibra) and Facebook Financial

- Facebook’s biggest source of income is small business

- Payments provide conversion information for ads that are 98% of revenues

- Privacy regulations and Apple iOS changes will impact ad tracking

- Facebook Pay and Libra could help with tracking

On Monday Bloomberg reported that Facebook’s David Marcus will now be responsible for a new division, Facebook Financial (F2). The move expands Marcus’ blockchain role from overseeing the Novi Libra wallet (formerly Calibra) to cover Facebook Pay and other payment apps.

Given David Marcus is the former President of PayPal, it makes sense to expand his oversight in what is seen as a current priority area.

The small business focus

One could read this as a diluted focus on Libra, but the move supports the strategy that Facebook has been touting for a little while: emphasizing commerce and small business in particular. In its second quarter earnings call two weeks ago, “small business” was mentioned 34 times. On the call, Mark Zuckerberg said: “Small businesses are the biggest part of our business.” Additionally, COO Sheryl Sandberg recently stated that “Facebook is the business of small business”.

That’s because most of Facebook’s ad revenues come from small businesses with the top 100 advertisers accounting for just 16%. Advertising was 98% of Facebook’s Q2 income of $18.7 billion. And the increasing importance of payments is to support advertising.

Zuckerberg also clarified the relevance of Shops. He said they allow “any small business to put in a catalog and then have a Shop across Instagram and Facebook to start, eventually across all of the apps. “

“You’ll be able to bring up a Shop, and you’ll be able to transact across all of them. And we’re building out Facebook Pay to make it so that you buy something in one place, your credit card is stored. It’s easier to do follow-on transactions in any of the apps. It will be a better consumer experience and sales will convert better. “

“There will also be a natural value for small businesses of being able to connect the advertising that they’re doing across their services with their Shops, to be able to go from inspiring someone at the top of the funnel all the way down through driving sales.”

Payments provide data, which helps in targeting ads.

Facebook Pay could counterbalance ad targeting “headwinds”

Advertisers will bid more if they can target high converting customers. So the more Facebook knows about customer spending habits, the better. Given the privacy pushback, that may be something that Facebook is a little less vocal about.

In the same Q2 conference call, Facebook CFO Dave Wehner outlined two obstacles that directly impact data for ad targeting. He mentioned the “California Consumer Privacy Act, as well as headwinds from expected changes to mobile operating platforms, which we anticipate will be increasingly significant as the year progresses.”

The California CCPA may be limited geographically, but one can expect other states to roll out similar privacy regulations, just as Europe’s GDPR doubtless inspired California.

The mobile change mentioned by the CFO is the upcoming iOS 14 release, which alters the Identifier for Advertisers (IDFA). Apps such as Facebook can track users who click on an advert in the Facebook app. So if someone clicks on a shoe shop advert, it could track them from the Facebook app to the shoe shop app or to a game. The change in iOS 14 requires an upfront user opt-in for IDFA, rather than the hard to find opt-out which 30% of users already select.

If you’re outside of the U.S., you’d be forgiven for thinking that iOS isn’t that big a deal. iOS has a 24.8% mobile market share worldwide, but in the U.S., it is 58.8%. Close to 50% of Facebook’s revenues come from North America, which accounts for less than 10% of its users.

So with these changes, Facebook will have less data for its ad targeting, directly impacting revenues. However, if it manages to increase Facebook Pay penetration, tracking payments may provide some of that lost data for ad conversion tracking. It could help if the shoe shop app uses Facebook Pay for checkout, but in third party iOS games, in-app purchases can’t be paid for with Facebook Pay.

Libra headwinds

The question is how might the Novi Libra wallet or Libra fit into this? For starters, Facebook can neither wait for the resolution of Libra’s regulatory issues nor for Libra’s development to progress.

While Libra’s latest makeover attempted to address regulator and central bank concerns about money laundering, the gatekeeper issue is harder. Central banks are effectively the gatekeepers to allow Libra to see the light of day and they believe Libra could challenge sovereign currencies. Libra has said it could primarily offer central bank digital currencies (CBDC), but even in that case, Libra could potentially become the gatekeeper for these sovereign currencies. That’s a conundrum with the current gatekeepers not keen to cede their position.

Just as importantly, Facebook needs to provide payment options for its users.

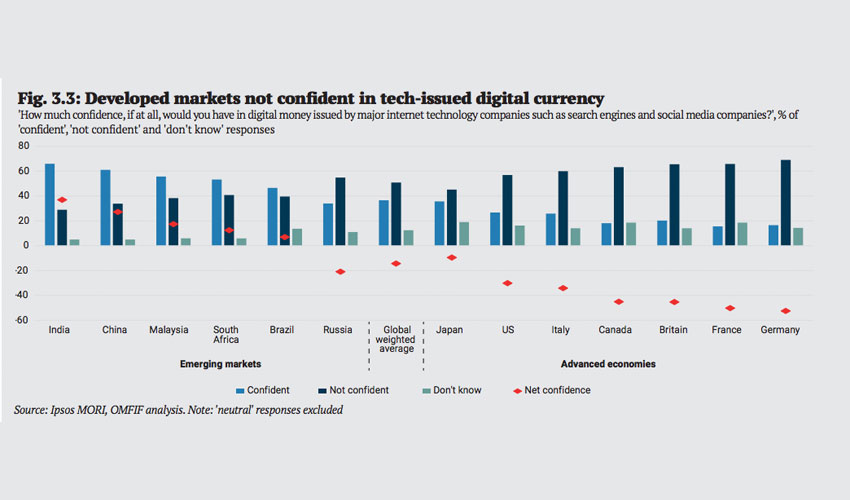

Earlier this year, central bank think tank OMFIF and Ipsos MORI published a global survey on digital currencies. It found that Facebook’s largest user base in India would trust a tech company to issue a digital currency, but Americans don’t.

Libra opportunities

Other Libra angles could benefit Facebook and its ad targeting headwinds. Two of the most promising consumer applications for cryptocurrencies are tokenized in-game assets and rewards.

If Facebook could integrate Novi to hold in-game assets for third party games, it may get the tracking back. The big question is whether Apple would allow that. It’s doubtful.

Another avenue is to get its small business customers to adopt token rewards which would be great for tracking. It could offer shoppers rewards for using the Novi wallet or Facebook Pay at checkout. That way Facebook achieves the end-to-end funnel that Zuckerberg referenced.

But even better for that funnel would be if blockchain could be used for ad tracking all the way through to payment.

There’s one big fly in the ointment with these ideas, but they only apply to Novi (Calibra) not Facebook Pay. In Senate testimony last year, David Marcus committed to not sharing certain data between Calibra and Facebook. “Calibra customers’ account and financial information will not be shared with Facebook, Inc., and as a result cannot be used for ad targeting,” Marcus said in written testimony.

There are numerous ways to achieve ad targeting while adhering to the letter of this statement. For one, a reward may not be counted as account or financial information.