Highlights

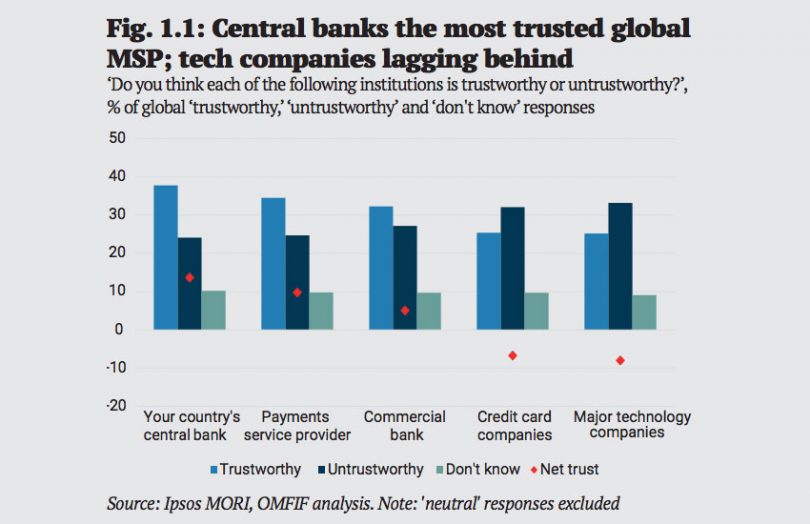

- Central banks most trusted, followed by payments firms

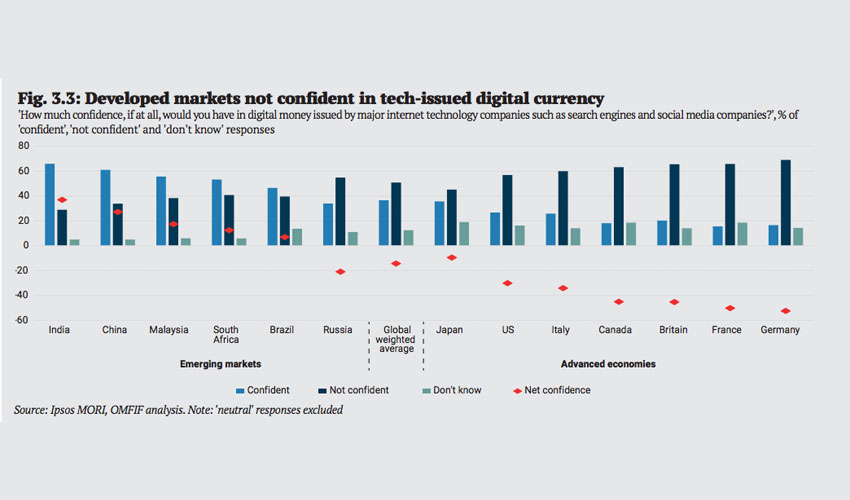

- Tech companies viewed with distrust, but not in emerging markets

- Emerging markets more open to digital currencies, developed world not so much

- Lower income have less trust in all methods of payment

- Security is the most desired payment characteristic, but least rated feature of digital currencies

A new Ipsos MORI / OMFIF survey into consumer attitudes towards money has found that central banks are the most trusted institutions.

It’s widely known that digital currencies are favored by well off younger men. But these demographic differences are small compared to nationality. The only thing people agree on worldwide is a strong preference for safety as a feature of money compared to convenience.

Generally, emerging-market citizens are much more trusting of all institutions that might issue digital currencies. That applies to tech companies who are heavily distrusted in developed economies. And in emerging markets, people have much more favorable attitudes to digital currencies of any type.

“The survey clearly shows that connected citizens in emerging markets are happy to accept digital money from almost any issuer, with a preference for central bank digital currency,” OMFIF concluded. “But in developed economies, respondents have very different preferences, and only limited appetite for a digital currency, even one that is issued by a central bank.”

OMFIF, the independent think tank for central banks and monetary policy, commissioned a MORI survey into consumer attitudes towards digital currencies and payments. The study involved 13,000 people in 13 countries, both advanced and developing economies.

Who to trust?

Although consumers trust central banks more than other payment providers, the results were not overwhelming. Less than 40% of respondents consider central banks “trustworthy”, and deducting the negatives gives a net figure of just 13%. Payment service providers like Paypal and Alipay were quite close behind and ahead of commercial banks. The laggards were credit card companies and technology companies, where the number of people that distrust them outstrips those that believe they are trustworthy.

The survey is pertinent, given all of these types of organizations might issue digital currencies in the future. OMFIF quoted François Villeroy de Galhau, the governor of the Banque de France, who claimed in January 2020 that “currency cannot be private, money is a public good of sovereignty.”

Who should issue digital currencies?

Consistent with views regarding trust, when asked about the different types of organizations that might issue digital currencies, central banks came out ahead in terms of confidence, scoring a 51% thumbs up. Payment services providers came second, followed by commercial banks. For both credit card companies and big tech there was a net negative response. While 37% of people said they would be confident in a large tech company, more than 50% said they would not.

India and Malaysia show a very strong inclination towards central bank digital currencies (CBDC), whereas sentiment in the U.S., Germany and Italy is on average negative. China was missing from the CBDC results which would be pertinent given its DC/EP pilots.

In emerging markets, even though there’s a preference for CBDC, there is a positive attitude towards most issuers of digital currencies, including technology companies, with the exception of Russia.

India is Facebook’s biggest market, and also the most trusting in a tech-issued digital currency. If the government were to allow the Libra digital currency, that market alone could be interesting.

When it comes to institutions, the Chinese have a lot of confidence in their commercial banks, with almost 60% trusting them and less than 20% finding them distrustful, giving a net positive 39%.

For all the types of organizations, the survey results showed a lower level of trust from lower-income and lower education households. With the exceptions of Russia and Japan, women generally are less trusting of both central banks and tech companies.

Payment characteristics

In all 13 countries, the survey found that for payment methods, people looked for safety from fraud and theft as the most preferred characteristic. This was also one of the lowest perceived features of digital money. With the exception of Japan, for all countries, more than 50% of citizens rank safety as the number one feature.

Other payment characteristics in order of importance were privacy protection as a dominant second, then ease of use, wide acceptance, and lagging far behind, speed. Generally, older respondents consider safety more critical, and the younger and better educated are more interested in speed.

When it came to all demographics, all the characteristics for cash, cards and digital currencies were scored lower by less wealthy respondents.

Digital currencies

When asked to compare digital currencies with cash and card payments, respondents were told this included bitcoin. This may explain in part why cash and cards ranked far higher than digital money. Emerging market participants were much more optimistic about digital money and had more confidence in all three mediums for payment. The most positive reactions about digital currencies came from India, China, South Africa and Russia in that order.

In emerging markets, 57% of people said they would have some confidence in any type of institution issuing a digital currency.

In developed economies, a lack of privacy protection was given as the main reason for distrusting digital money, especially in Germany (41%) and France (34%).

In terms fo the characteristics of digital money, speed ranks first, followed by ease of use, wide acceptance, safety and privacy protection. When compared to the desirable characteristics of payment methods, these results are a marked contrast.

Three months ago OMFIF published another survey into central bank perspectives on CBDC. The BIS published one last month.