Today dGen, a non-profit think tank focused on emerging technology, published a paper exploring central bank digital currencies (CBDC). In particular, it looks at a potential digital Euro and the geopolitical ramifications of CBDC.

It predicts that a digital yuan will not unseat the U.S. Dollar but represents a major challenge to the world’s number two reserve currency, the Euro. In fact, dGen says that Europe needs a CBDC by 2025 to stop this happening.

It quotes Philipp Sandner of the Frankfurt School Blockchain Center: “[The] ECB’s reaction has been too slow. Especially, the benefits from a CBDC for the industry, e.g., based on programmable money, are currently neglected. Given Libra and the [Chinese] DC/EP, the ECB has to react quickly to keep its geopolitical position”.

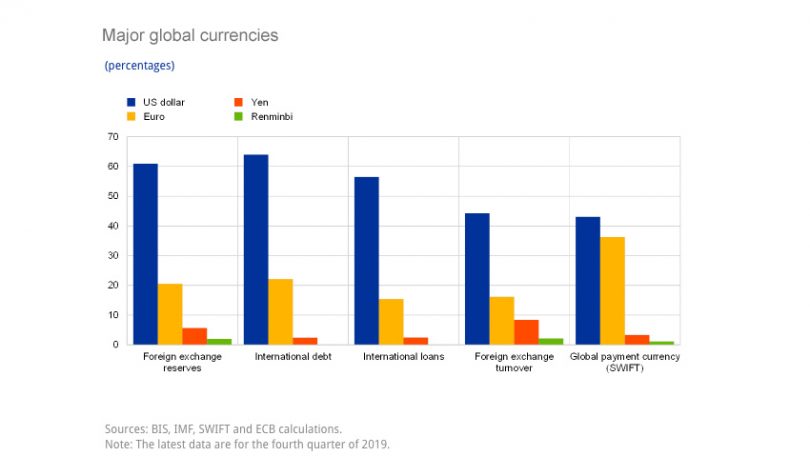

The digital yuan has not yet launched, but testing of the DCEP is progressing. That said, if it is to overtake the Euro, it has some catching up to do. Right now, the yuan or renminbi is in the fifth spot in terms of global reserves at $221 billion. That compares to the U.S. Dollar with $6.8 trillion and the Euro with $2.2 trillion. The other top-five currencies are the Japanese Yen and the British Pound.

Last week Morgan Stanley predicted that the yuan could claim the number three spot within ten years.

dGen argues that China’s Belt and Road Initiative plays a critical role. The significant investment in other countries’ infrastructures will have a lasting impact on global trade. It points to the ongoing trade war with the U.S. and China and Russia’s moves to circumvent SWIFT for payments because it has been politicized.

The paper also refers to a March report that several countries, including China, Russia and India, have agreed to conduct bilateral trade in currencies other than the dollar. We’d view that report with a little skepticism in the first place but even more so given India’s recent fallout with China.

A digital yuan will not unseat the dollar anytime soon, concludes the report. It said there needs to be greater incentives and confidence in China’s currency before global reserves shift significantly. But it does predict the renminbi will gain significant market share. At the same time, in the five to ten year period while economic powers battle over currencies, other private currencies, including stablecoins, could emerge as contenders.

Another prediction is that three to five nations will completely replace their currency with a CBDC by 2030. It points to the pilots being conducted in Sweden and the Bahamas. That’s consistent with research from the Bank for International Settlements (BIS).

The report also argues that some smaller nations may adopt a digital dollar as a path of least resistance. That’s assuming the U.S. issues one first. That makes sense given countries such as Zimbabwe have gone through periods of adopting the dollar, circulating paper dollar notes held together by sellotape.