The ECB has opened applications for two sets of participants for digital euro trials. “Pioneer” partners will test conditional payments...

Digital euro

The European Union is on track to be the first advanced Western economy to launch a retail central bank digital currency (CBDC), the digital euro.

As with other CBDCs, privacy is a major concern. The European Central Bank (ECB) and national central banks won't have access to private data. Banks and other payment providers will act as intermediaries and provide wallets for the digital euro. Those that don't have their own wallet can use an ECB provided one.

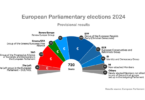

With Big Brother concerns, there were question marks as to whether the EU Parliament would give it the go ahead. The latest draft regulations have made significant changes, particularly addressing bank concerns about a flight of deposits.

The first Parliamentary Committee vote was heavily in favor of the digital euro. Based on the parties involved, a full vote of parliament would likely also be supportive.

In October 2023, the ECB started a two year preparation phase, after which a launch decision will be made. The likely timeframe would be 2027.

Some EU states unhappy with ECB controlling digital euro limits – report

Politico reported that some European states, including Germany, France, the Netherlands and six other countries, are concerned about the...

Has ECB cracked the code for digital euro CBDC adoption?

Two economists at the European Central Bank have modelled how to get consumers to adopt a central bank digital currency (CBDC) and the...