The current COVID-19 pandemic has increased the preference for using digital forms of payment and avoiding cash transactions. A recent survey by The Economist Intelligence Unit revealed that 64% of the respondents used digital payments for over half their purchases in the past year.

The survey involved 3,048 people, half of whom are from developed economies, with the other half from emerging markets. With respect to age, 61% of respondents were 18-38 years old — the tech-savvy generation.

Digital payment is a broad term and encapsulates cryptocurrencies, internet banking, Paypal, WeChat Pay, among other things. The report titled ‘Digimentality — Fear and favouring of digital currency’ found that over 80% of the respondents were willing to use digital payments for daily transactions. On the other hand, only 4% said they would prefer using only cash.

A trend observed in the survey was that developing economies were more receptive to the adoption of digital payment modes. This was demonstrated by 41% of respondents from developing economies owning cryptocurrencies, versus 19% in developed economies.

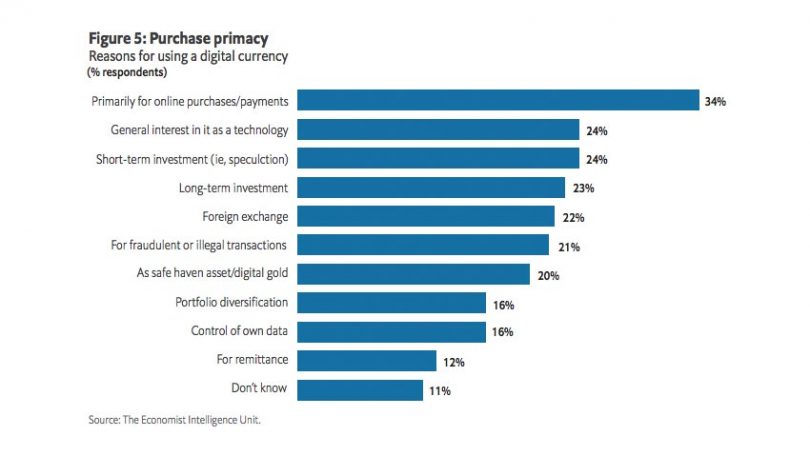

While digital currency can serve several purposes, about 34% of the respondents use it primarily for online purchases and payments. A significant proportion use cryptocurrencies for speculative or investment purposes.

Previously, a report by Ipsos MORI / OMFIF found a similar trend where emerging economies favored digital currencies over developed economies. Another observation was that consumers trusted central banks more than any other financial entity.

The Economist found that 54% of respondents cited government issuance as a trust factor in digital currencies. On the other hand, 38% said crypto backed by no particular organization was not trustworthy. This indicates that a central bank digital currency (CBDC) would be much more popular than Bitcoin is currently.

However, digital currencies and CBDC still have an uphill climb for broader adoption. When considering digital payments, 61% of the respondents say data privacy is their biggest concern. A third of the respondents (32%) said security was another contributing factor to the slow adoption of digital currencies. The biggest hurdle of all is that the use of digital currencies is not well understood (44%).

Meanwhile, CBDC projects are popping up across the globe. China is likely at the forefront with its digital yuan, and started pilots earlier this year. France, Lithuania, European Central Bank, and Canada are among the several exploring CBDCs.