Earlier this week, research firm CB Insights said that investment in blockchain startups dropped significantly in 2019. However, CB Insights found that enterprise applications were thriving and dominated capital raised in the last quarter. In Q4, Ripple raised the most cash, and yesterday its CEO hinted at an IPO.

Total equity funding in blockchain technology fell over 30% in 2019, while mentions of the technology in financial releases also dropped significantly. CB Insights said the slip could be attributed to a lack of product and market fit.

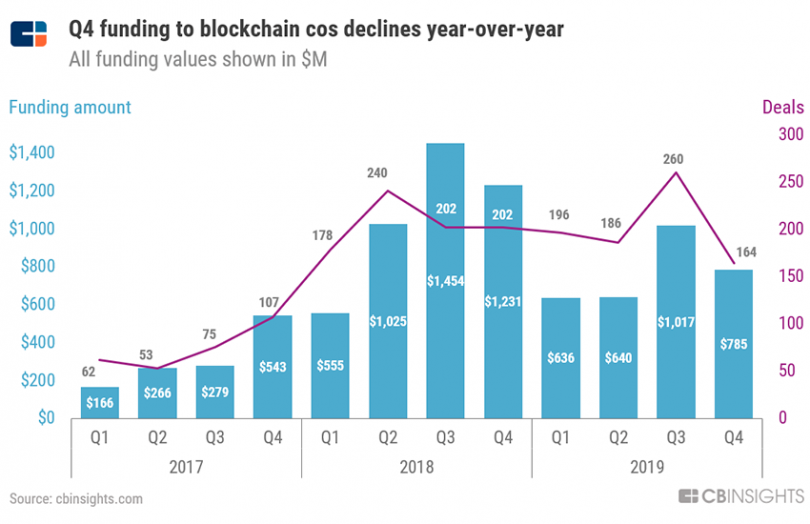

Year on year, dollar funding for blockchain initiatives was down 28% in 2019 from 2018’s peak of $4.3 billion. Meanwhile, the deal activity remained flat.

In Q4 2019, blockchain companies raised $785 million across 164 deals, a 36% fall from the corresponding period last year. Four of the five biggest deals were for blockchain firms targeting enterprises.

Blockchain payments firm Ripple was the top contributor to the Q4 figure, securing $200 million in Series C round led by SBI Group, Tetragon, and Route 66 Ventures. The company was valued at $10 billion.

Yesterday, at the sidelines of the World Economic Forum, Brad Garlinghouse Ripple’s CEO hinted at a near term IPO.

“In the next 12 months, you’ll see IPOs in the crypto/blockchain space. We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side,” said the CEO of the payments company. “It’s a natural evolution for our company.” The comment was tweeted by Ripple SVP Asheesh Birla.

Ripple said it saw a 10x growth in transactions in 2019, and its customer count hit 300. The company offers cross-border payment solutions, using a blockchain messaging system called RippleNet, which competes with SWIFT. The second solution is On-Demand Liquidity, which uses the XRP cryptocurrency for fund transfers. Ripple said it plans to use the funding money for additional hiring, overseas offices, and improving balance sheet flexibility.

Meanwhile, most other big deals involved companies looking to streamline business operations.

San Francisco-based Figure Technologies raised $103 million in Series C funding to develop its lending blockchain platform Provenance further. Figure became unicorn with this round, at a valuation of $1.2 billion. The firm is currently offering home equity lines of credit on its blockchain platform and is actively exploring student loan refinancing and conventional mortgages.

Last month, blockchain startup Digital Asset Holdings announced a Series C funding of $35 million. The company plans to use this money to fund developer community initiatives for its Digital Asset Modeling Language (DAML), a smart contract language that is supported by several enterprise blockchain protocols, including Hyperledger Fabric and R3’s Corda.

Another significant contributor to the blockchain deals figure is PeerNova, which raised $31 million in October. PeerNova is a blockchain fintech that aims to create a golden copy of transactions for financial institutions to reduce the need for reconciliations.