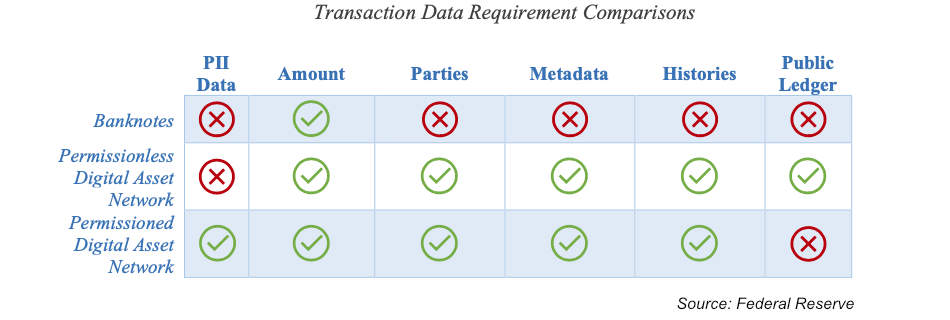

The Federal Reserve published a paper that explores various privacy strategies in digital asset ecosystems. A key point is that cash like anonymity is very unlikely in digital systems. Confidentiality from certain parties is the best to hope for.

It asserts the desire for cash-like anonymity is based on a misunderstanding of how digital systems work. Even with encryption, activity logs and audit trails leak small pieces of information. Of course, current versions of most public blockchains reveal an enormous amount of data which is easy to link to an identity by tracing wallets back to exchange onramps.

Although it may be true that anonymity is almost impossible to achieve in the digital realm, people desire it. While comparing digital systems to cash at a practical level, the paper doesn’t acknowledge the broad recognition that digital money will accelerate the crowding out of cash.

And hence digitalization will remove all future potential for anonymity. It is this point that is instinctively understood by many.

The paper attempts to be generic, covering all types of systems, including public and permissioned blockchains. However, it is clearly a central bank paper as it distinguishes between the issuance layer and the circulation layer, a concept that’s common for central bank digital currencies (CBDC) and not so much elsewhere.

A common CBDC approach to anti money laundering (AML) aims to enable “‘anonymous’ (more likely confidential)” transactions by allowing small value payments without KYC and AML. Illicit actors could still break up large transactions into smaller amounts to circumvent controls. That’s particularly if transaction value limits is used as a singular control. This leads to a key theme in the paper – rather than adopting single privacy strategies, there should be hybrid approaches.

It also mentions the ability for a small intentional data disclosure to build into something far bigger and unintended. Privacy enhancing features often have a heavy computer load, resulting in poor transaction performance. A user might opt out of a privacy feature to achieve faster settement. However, this may “unintentionally degrade their privacy within the ecosystem and, possibly, degrade the payment system’s collective privacy.”

It’s not surprising that the Federal Reserve is publishing a paper on privacy. There are two key reasons whey CBDCs might fail. One is the populist pushback that’s privacy related. Sometimes that’s based on conspiracy theories. But as the Financial Times reinforced this week, there is substance to concerns. Even if a current government has good intentions, a future one might not. The second reason that CBDCs might fail is if the public doesn’t see any usability benefits over the existing private solutions already in use.

In a recent paper, the RBC asserts that a U.S. digital dollar has the potential to politicize the role of the Chair of the Federal Reserve.