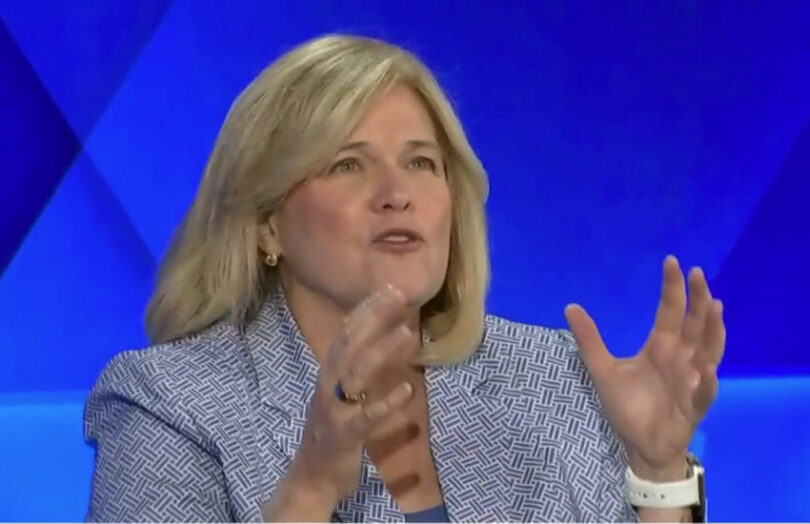

Jenny Johnson, the CEO of asset manager Franklin Templeton, said tokenization is securitization on steroids. She was talking during the CNBC Delivering Alpha event. As bullish as she is about blockchain, she’s also pragmatic that it’s a long game.

Ms. Johnson discussed how public companies must invest in the future given the current technological changes. And she referenced her own role in Franklin Templeton’s commitment to blockchain. “We’re doing a lot in that space. But I don’t think it pays off for five, seven, ten years,” she said.

Franklin Templeton has a tokenized money market fund that has on chain assets of $296 million. However, despite the transfer agent using public blockchain, for now it also has a conventional database for SEC compliance.

Tokenization is securitization on steroids

Talking in more detail about blockchain and tokenization, Ms. Johnson said, “Bitcoin is the greatest distraction from the greatest disruption coming to financial services.”

“If you bring the technology down to its core value, it does three things. One is it allows a payment mechanism. Two is it allows smart contracts to be programmed into the token. And three, because it’s a general ledger, it has a source of truth. So whoever has that token, all rights in that token are granted to that person.” She made similar comments earlier this year during the Consensus event.

She gave the example of an NFT that incorporates a tiny fraction of royalties for each play of a Rihanna song, without involving intermediaries. We believe a song producer released the NFT, rather than the singer.

“Think about anyway in which you have revenue streams or royalty streams that you can now start to fractionalize or democratize that. And think about how that is an uncorrelated asset to all the traditional assets,” said Ms. Johnson.

“If you think about it, it’s just securitization done on steroids. And it’s merely that this technology is enabling it. And it’s also enabling other very interesting companies that will disrupt some of the traditional business models that we have today.”

Securitizations generally have SEC implications. The particular NFT Ms. Johnson referred to was delisted from OpenSea because it sold future rights to revenues. However, it appears to be listed currently.

Recently, the SEC has pursued NFT projects, including ones that don’t look particularly financial.