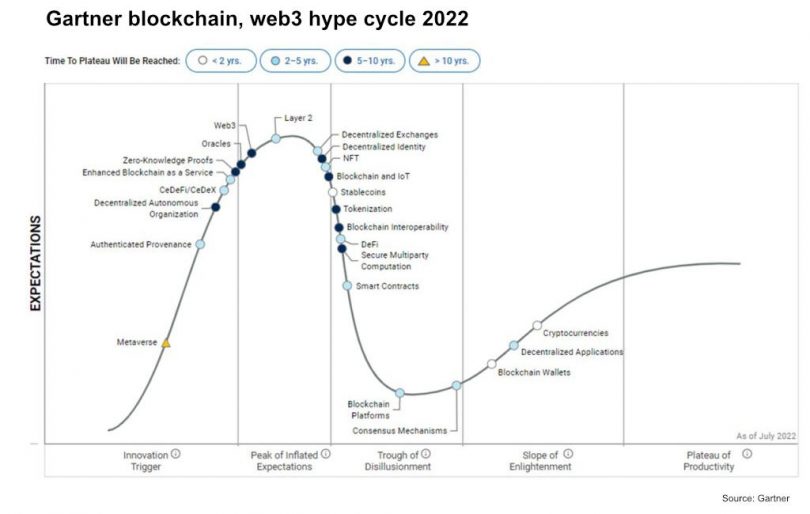

On Friday, Gartner unveiled its latest blockchain and web3 hype cycle. An associated blog post claims that cryptocurrency trading is the only killer app so far. Unsurprisingly, not everyone agrees, and the hype cycle’s individual elements are being debated in multiple posts on Linkedin. [1][2]

“Consumer apps like NFT games and commerce are driving innovation as enterprises gradually begin to realize business value. A tipping point in adoption will soon be reached, as risks are managed proactively,” says Avivah Litan in a blog post. And goes on to say, “other than cryptocurrency trading, we still have not seen killer use cases yet. They need to leapfrog over current applications in terms of making our lives better.”

Perhaps the blog post intended to spur debate.

While monkey pictures may grab the headlines with NFTs, the technology will hugely impact almost every type of intellectual property, from art to music and games. And NFTs will underpin the future of brand loyalty. Not forgetting that OpenSea alone traded more than $30 billion in a year. But in fairness to Litan, much of that figure was money received via crypto trading. And while NFTs are promising, they are still niche.

It’s possible to debate every item in the cycle. But one comment in the blog post deserves more attention.

Blaming CeFi for crypto crash?

The cryptocurrency crash is largely blamed on “corrupt players who lied to customers or lenders” whereas DeFi protocols did not crash. There’s no question that centralized crypto lenders were an accident waiting to happen with weak risk management. But what really saved DeFi is that it has mainly granted over collateralized loans (so far), and automated smart contracts protect the collateral. In contrast, CeFi loans were under-collateralized.

And DeFi is starting to move into under-collaterilized loans.

Also, the unraveling of many of the CeFi issues (with one big exception) started with DeFi. The collapse of the algorithmic stablecoin Terra USD – where the Anchor DeFi protocol offered 20% rates – was a key trigger, wiping out $50 billion-plus in one swoop. It resulted in the losses which crippled Three Arrows Capital (3AC), and 3AC brought down Voyager Digital and caused massive defaults for Genesis lending and others. Not only that, but the de-pegging of the Terra stablecoin started with an unbalanced Curve DeFi pool.

It’s worth clarifying because the ‘DeFi good, CeFi bad’ message is overly simplistic and could result in people blindly trusting DeFi. Like they did with Terra/Luna. While DeFi is incredibly promising, it comes with significant risks, which will grow as DeFi becomes more complex and less transparent.