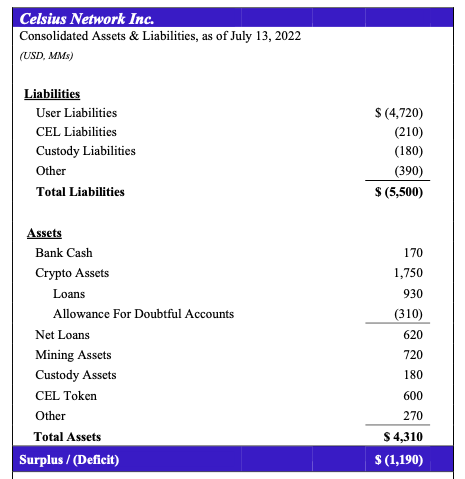

As part of its Chapter 11 bankruptcy filings, cryptocurrency lender Celsius Networks filed a statement from CEO Alex Mashinsky. The most astonishing thing about the document isn’t the $1.2 billion shortfall. It’s that the CEO seems to genuinely believe the company can be restructured and won’t be blocked by every regulator around the globe.

The jaw-dropping document is a page-turner for all the wrong reasons. For example, Tether, the company with the largest stablecoin, is one of just four corporate investors in Celsius. The size of the investment is unclear.

The document appears to allege that the company already had a hole in the balance sheet before its Series B funding which raised $690 million in late 2021.

Mashinsky talks about the rapid growth in 2020 and 2021. “During its growth, the Company suffered a series of losses that impacted its ability to match its assets and liabilities,” he wrote.

Two big setbacks mid-2021

One major issue is a deal with an un-named private lending platform where it deposited collateral that was not returned in July 2021. The platform is paying it back at $5 million a month but currently owes $439 million. If it continues to pay, that will take more than seven years to resolve. Update: The Financial Times says the private lending platform is EquitiesFirst, citing un-named sources.

Also in mid-2021, Stakehound lost the keys to 35,000 ETH owned by Celsius, which we estimate was then worth around $95 million.

Modest crypto crash losses

Specific losses suffered during the crypto crash appear to be relatively modest. Based on the paper, we estimate they were just over $167 million, whereas there’s a $1.2 billion balance sheet hole. Considering it recently raised $690 million funding, the gap is closer to $2 billion.

It had an $841 million loan from Tether which experienced a margin call and was liquidated, resulting in Celsius losing $97 million.

On the Luna/Terra collapse, it dropped $15.8m and another $40 million on Three Arrows Capital.

It also staked a significant amount of stETH: 410,421. If one counts the valuation difference between ETH and stETH we estimate a gap of around $15 million. These four losses amount to $167 million.

The immediate issue was the sudden demand for withdrawals which the company couldn’t meet because it didn’t have sufficient liquid assets. That was only partly because of the hole.

Co-mingling on a grand scale

Early on in the document, there are hints of what’s to come when Mashinsky highlights that the Celsius terms and conditions state that when people hand over cryptocurrency to Celsius, the company can do pretty much whatever it wants with it.

And it did.

For example, it granted a $750 million loan to its Bitcoin mining subsidiary, which currently owes it $576 million. And it spent $115 million on crypto custody provider GK8, which it confirms is now in play.

It’s mind-boggling that WestCap and Caisse de dépôt et placement du Québec “one of Canada’s largest pension funds” together invested $400 million in October last year. Who did the due diligence? On the back of these two names, others invested another $290 million.

The document also appears to have inconsistencies. For example, the text states it has $130 million in cash, but the schedule shows $170 million.

Turning to lending, the details say there are outstanding retail loans of $411 million and institutional $93 million, both with significantly more collateral. Yet the balance sheet shows $930 million with a provision. So what are the other loans? It is not the Bitcoin mining one because intercompany loans are set off in a consolidated balance sheet.

Still many unanswered questions

Based on our analysis, there’s still a lot of explaining to come up with a shortfall of $1.2 billion or $1.9 billion if you include the Series B funding.

No question, this document makes a good read. One can almost hear the SEC’s Gary Gensler saying: “I told you so.”