Last night crypto lender Celsius Networks filed for Chapter 11 protection in New York bankruptcy court (court filing here). The company waited a whole month after pausing withdrawals on June 13 before it filed for Chapter 11 protection from creditors.

Alex Mashinsky, Co-Founder & CEO of Celsius appears to be optimistic that the company will emerge from the process. “I am confident that when we look back at the history of Celsius, we will see this as a defining moment, where acting with resolve and confidence served the community and strengthened the future of the company,” he said in a statement.

Update: Mashinsky filed a statement with the bankruptcy court revealing a $1.2 billion balance sheet hole. It makes shocking reading.

As of mid-May, Celsius had assets under management of $11.8 billion. It raised $750 million from Canadian firms WestCap and pension fund Caisse de dépôt et placement du Québec late last year. The bankruptcy filing puts assets and liabilities between $1 billion and $10 billion. The company has 300,000 active accounts with balances of more than $100.

Court documents haven’t yet clarified the specific reason for the company’s distress. It filed its list of largest unsecured creditors, but so far not the debtors. In contrast, when Voyager Digital filed for bankruptcy, it was clear the trigger was the default of crypto loans to Three Arrows Capital.

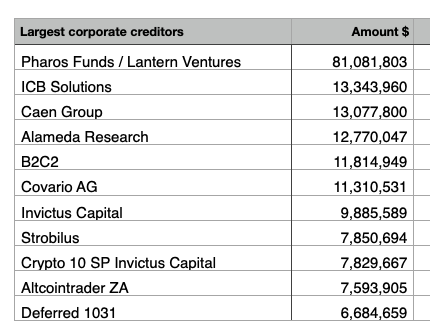

Alameda, B2C2 are creditors

Some high profile names are on the list of named corporate creditors, including Sam Bankman-Fried’s Alameda Research and market maker B2C2 (owned by SBI) which are owed $12.7 million and $11.8 million, respectively. However, in the case of Voyager Digital, it became clear that Alameda was a far bigger debtor than creditor.

The largest unsecured corporate creditor ($81m) is Pharos Funds, Cayman Island structures associated with Lantern Ventures, a UK-based proprietary trading firm where Naia Bouscal is the controlling shareholder. Similar to Sam Bankman-Fried, Bouscal says the company follows the concept of effective altruism, with the firm donating 50% of its profits. As of February, Bouscal outlined plans to generate $200 million in donations in 2022.

Thirty-nine of the 50 largest unsecured creditors are individuals. Each is owed more than $5 million, of which four are owed between $20 and $41 million.

Celsius says it has $167 million in cash on hand. Kirkland and Ellis is the legal advisor and is also working on behalf of Voyager Digital.

Crypto custodian GK8 in play?

Last year Celsius announced it acquired digital asset custody firm GK8 for $115 million. We contacted GK8 earlier this week to ask them about their current status but didn’t receive a response. The company’s website makes no mention of Celsius apart from the acquisition announcement. If the Celsius – GK8 deal completed, the bankruptcy administrators will likely look to sell it.