Leading Asian taxi and delivery platform Grab has launched a blockchain-based voucher promotion linked to the Singapore Grand Prix. Last year the Monetary Authority of Singapore (MAS) unveiled Project Orchid for programmable payments or purpose bound money (PBM). The Grab web3 initiative that uses NFTs is one of several PBM trials.

Conceptually, a visitor buys a voucher pack described as an “NFT voucher” because each pack is unique. Under the hood, the NFT unlocks a quantity of straitsX XSGD stablecoins with conditions attached. Users can only spend the stablecoins at certain outlets. At a few merchants, the user receives a digital collectible NFT when they make a purchase.

The web3 firms involved are the Singapore regulated stablecoin issuer straitsX, and Circle, which in this case provides its new web3 services platform rather than its USDC stablecoin. Grab uses the Polygon blockchain.

While it’s a great idea, the SG Pitstop Pack is more likely to appeal to the crypto crowd as it requires some patience to jump through the steps. And crypto jargon abounds on both the apps involved.

- A user has to buy NFT vouchers from the fave voucher website (similar to Groupon). Buyers pay $12 and receive $14 worth of vouchers that they can use at more than a dozen events and restaurants.

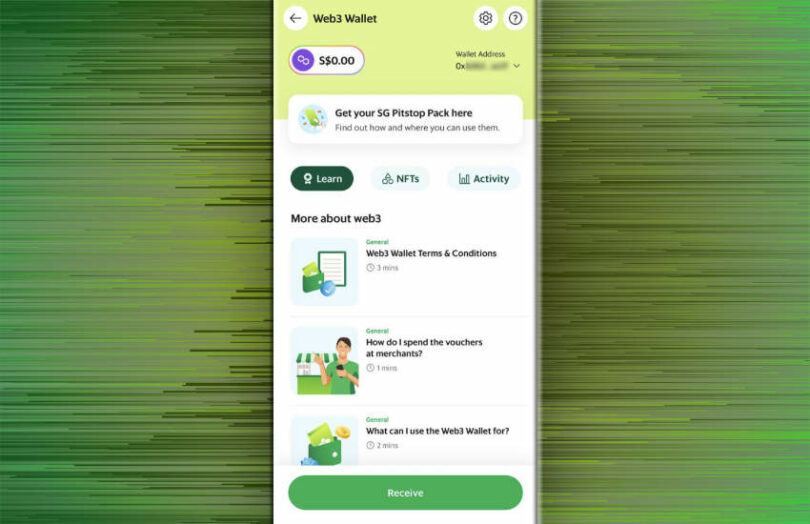

- From within the Grab app, the user has to create a web3 wallet if they don’t have one.

- They redeem the fave voucher code within the web3 wallet.

- They can then scan a QR code at one of the participating outlets to spend the voucher. If they don’t use the $14, they don’t get change. It’s unclear who gets the unspent stablecoins – likely Grab or StraitsX.

- When the user spends the voucher at certain specified outlets they also receive a digital collectible.

Purpose Bound Money

After unveiling Project Orchid last year, in June MAS released a Purpose Bound Money standards whitepaper. Several central banks have announced they will not issue “programmable money” if they proceed with a CBDC. The ECB’s Fabio Panetta said, “central banks issue money, not vouchers.”

Purpose Bound Money does not just apply to CBDC, but also to stablecoins and deposit tokens.

However, most central banks are okay with “programmable payments”, involving time or event triggers. MAS says purpose bound money is somewhere between the two. It has support elsewhere as the central banks of Korea and Italy participated in the latest whitepaper alongside the IMF. It remains to be seen if Italy remains supportive of the concept after Panetta becomes Governor of the Bank of Italy on November 1.