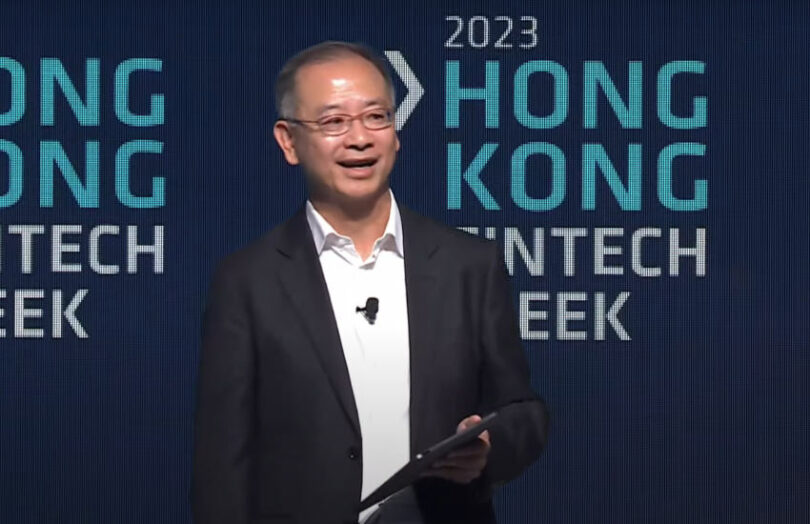

Christopher Hui, Hong Kong’s Secretary for Financial Services and the Treasury, outlined a raft of regulations planned for the tokenization sector. He was talking today during the Hong Kong Fintech Week.

First off he addressed the JPEX scandal in which the crypto exchange collapsed owing to alleged fraud. “We’ve been asked many times whether JPEX will affect our determination to grow the web3 market. The answer is a clear no,” said Mr. Hui.

This June new regulations came into force for cryptocurrency exchanges. But most of the coming regulatory work is not in the crypto sector. However, Mr Hui mentioned plans to expand the virtual asset regulations beyond exchanges. On the one hand, that could mean DeFi. But it’s more likely to focus on token issuance, wallets and the like.

Regulation of tokenization

Much of the coming work will impact traditional finance (TradFi). It includes:

- a circular for intermediaries engaging in tokenized securities

- a circular re tokenization of SFC-authorized investment products

- and the banking regulator will continue to consult with banks regarding digital asset custody services.

Additionally, the Treasury and Hong Kong Monetary Authority (HKMA) will issue a joint consultation on stablecoin regulations.

HKMA sees a rosy future for tokenization

Eddie Yue, CEO of the HKMA followed Mr Hui’s talk. He envisages tokenization driving increased usage of blockchain payments including stablecoins and tokenized deposits. And he believes central bank digital currency (CBDC) will act as the foundation and glue for interoperability.

Mr Yue discussed Hong Kong’s February tokenized green bond issuance and said discussions with the industry are already progressing for the next bond.

However, with tokenization more generally, he also sees challenges.

“Despite all the promising signs, there are still a lot of challenges ahead. For example, we need to address questions such as how do we legally define tokenized securities or whether DvP (delivery versus payment) can really be achieved for tokenized securities,” said Mr Yue.

“Not to mention the very complex legal considerations and the interoperability challenges that are already under discussion in the central bank community.”

Meanwhile, yesterday HSBC revealed tokenized deposit experiments with Ant Group as part of the HKMA sandbox.