Introducing a central bank digital currency (CBDC) in the Eurozone within a few years is widely considered a foregone conclusion. That’s partly due to the European Central Bank’s (ECB) enthusiasm. However, this is all subject to the approval of supporting legislation for the digital euro. While draft legislation has been discussed and debated, it was not approved by the full parliament in advance of this week’s elections. Subject to numerous caveats, the provisional election outcome looks favorable for the digital euro.

In February, the parliamentary European Committee on Civil Liberties and Justice (LIBE) voted overwhelmingly in favor of the latest digital euro report. Forty eight MEPs voted in favor with just six opposed and seven abstentions.

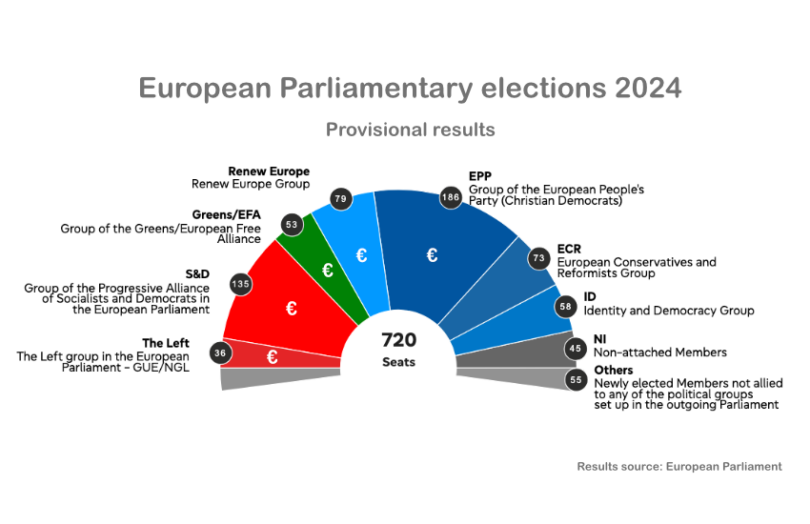

All the left-leaning parties voted in favor – the S&E, Renew, Greens and The Left. They were also joined by the EPP, the central right party, which was and remains the largest group of MEPs and was part of the last ruling coalition. Assuming the same parties vote in favor, they control 68% of parliamentary votes after the 2024 elections.

The last government coalition consisted of the EPP, the Socialists (S&E) and Renew. With the provisional election results, this group still controls 400 out of 720 seats.

Additionally, the previous rapporteur for the digital euro and MiCA was Stefan Berger, an EPP member who has been re-elected.

There are three caveats about the election being favorable for the prospects of a digital euro. They include the likelihood that a previous coalition persists, the EPP continuing to support a digital euro, and the votes in an earlier sub-committee being reflected in a broader parliamentary vote.

Pause for thought?

A CBDC has the potential to be a useful tool in the hands of a benevolent government. However, those who favor free markets tend to disagree. The recent lurch to the far right should give some pause for thought.

Even if a CBDC is designed to limit government interference, once in place its design can be changed. A CBDC with traction has the potential to be a powerful exclusion tool in the wrong hands. On the other hand, the same probably applies to the banking system in the scenario of a not-so-benevolent government.