An observation in the IMF’s recent Digital Asset Platforms paper is that conventional finance tends to tightly combine assets with the platform on which they exist. For example, a bank’s money is only usable on its own banking platform. In contrast, with digital assets, the asset could exist on multiple platforms. Consider a stablecoin issued on multiple blockchains.*

Interoperability is widely recognized as a topic that sorely needs addressing for digital assets. The internet protocol TCP/IP is credited with enabling internet interoperability. The IMF authors ask, “What is the TCP/IP equivalent for digital assets?” They borrow another concept from the internet era, the OSI model, which separates networks into layers.

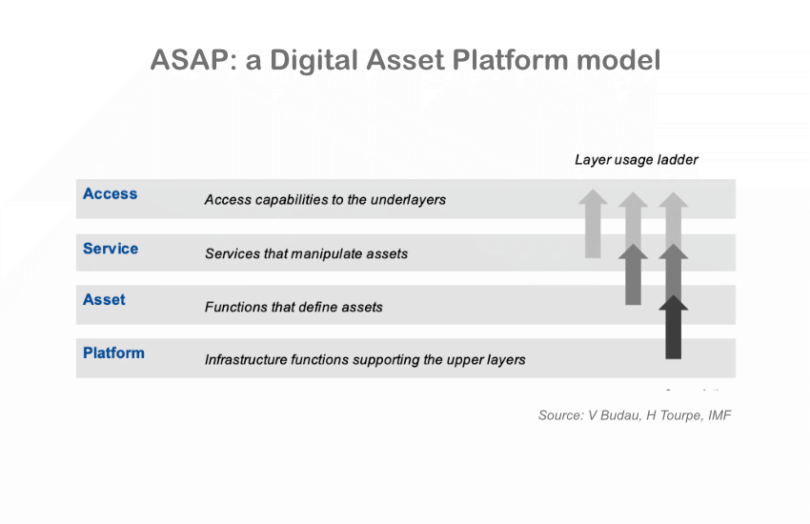

For digital assets the authors define four layers that make up a Digital Asset Platform (DAP), the ASAP model. The layers are

- the Platform (eg. a blockchain)

- the Asset (eg. a CBDC or bond)

- the Service (eg. a lending protocol) and

- the Access (eg. a website, wallet).

The authors highlight that the asset and service layers are understudied. They have a lot of potential to address the issues of interoperability of systems, governability and risk.

Why the focus on asset and service layers?

On the one hand, the Platform layer is highly competitive and evolving, there are lots of blockchains and distributed ledger technologies (DLTs). Platform ecosystems and software vendors aren’t incentivized to engage in standardization at the base layer and it’s complex to do so.

On this point, we’d observe the proliferating number of base networks. Numerous banks have launched their own digital asset platforms underpinned by separate blockchain networks. Plus, there are several large scale initiatives such as the Unified Ledger and Regulatory Liability Network.

At the other end of the spectrum, the Access layer has attracted a lot of attention, particularly from Payment Service Providers. There is an element of standardization such as QR code formats. Plus, the Access layer can build on the standards developed at the asset and service layers, such as the Ethereum token format ERC20.

Talking about the Asset and service layers, the authors state:

These two layers offer an avenue where the financial sector can harness its potential for coordination to attain interoperability. Just like the ERC20 standard allowed unprecedented composability of assets and services on the platforms that support it, a standardization effort in these layers may bring efficiency in channeling the resources of the financial sector in this regard and effectiveness in delivering the important externalities brought by the interoperability.

A specific example highlighted in the paper is the Monetary Authority of Singapore’s concept of Purpose Bound Money (PBM). Central banks are wary of programmable money, but PBM allows a company to build on top of an asset, for example by creating vouchers. It adds a wrapper to the asset – a CBDC, deposit token or stablecoin – and then adds PBM logic at the service layer.

Next steps

This is the first in a series of IMF papers, with the next one focusing on developing a model for the Asset layer. The aim is to use this work to address interoperability and risks.

* The paper doesn’t give the example of conventional stocks, perhaps because you can have depository receipts enabling trading on another platform. That’s not a million miles away from locking and wrapping tokens on a different blockchain. However, depository receipts require a trusted intermediary. The point about separating the platform and asset layers is still entirely valid.