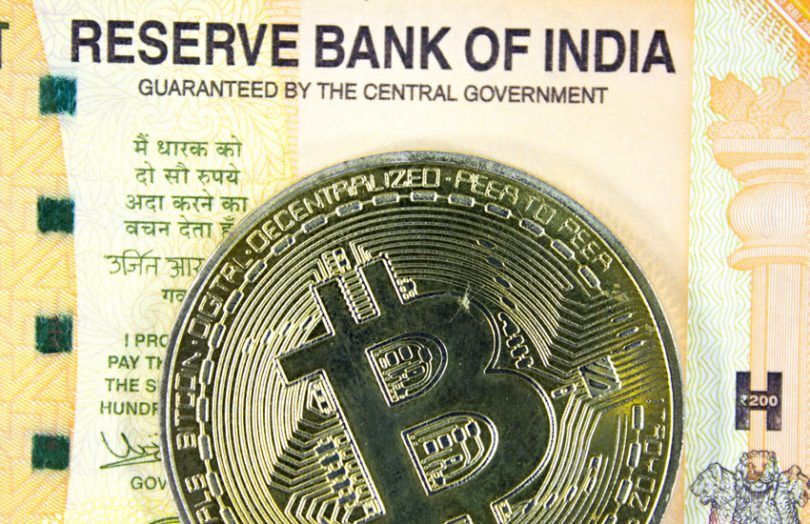

Earlier this week, the Supreme Court of India annulled the Reserve Bank of India (RBI) circular which aimed to curb cryptocurrency trading. The RBI is now planning to file an appeal because it is concerned that cryptocurrencies “put the banking system at risk”, reported The Economic Times.

Just last night the RBI took control of Yes Bank, the country’s number four lender. That’s the second bank in six months after the central bank stepped in over PMC Bank last September.

On April 6, 2018, the RBI issued a circular preventing banks from providing services to cryptocurrency exchanges. The tokens themselves are not banned. This led to the closure of several exchanges, accounts of some were frozen, and others shifted base out of the country.

In its Wednesday ruling, the Supreme Court said that the RBI ban was invalid. The court made three points. Firstly, in the last five years the central bank has not found that cryptocurrencies adversely impacted RBI regulated entities. Secondly, the RBI has not prohibited cryptocurrencies themselves.

And thirdly, an inter-ministerial committee considering legislation was of the opinion that a ban might be too extreme. Instead, the committee said the more likely regulatory route would be to classify tokens as securities and regulate exchanges.

Opening the floodgates

Hours after the ban was lifted, one of the petitioners, crypto exchange CoinDCX claimed it had already integrated bank account transfers, enabling crypto payments in fiat currency.

“Integration of banking channels makes the whole process of crypto adoption simpler,” said Sumit Gupta, Co-founder, and CEO of CoinDCX.

“With renewed accessibility and convenience in purchasing cryptocurrencies, we believe that this change will have a dramatic effect in accelerating crypto adoption in India,” Gupta added.

And that’s precisely what the RBI is worried about.

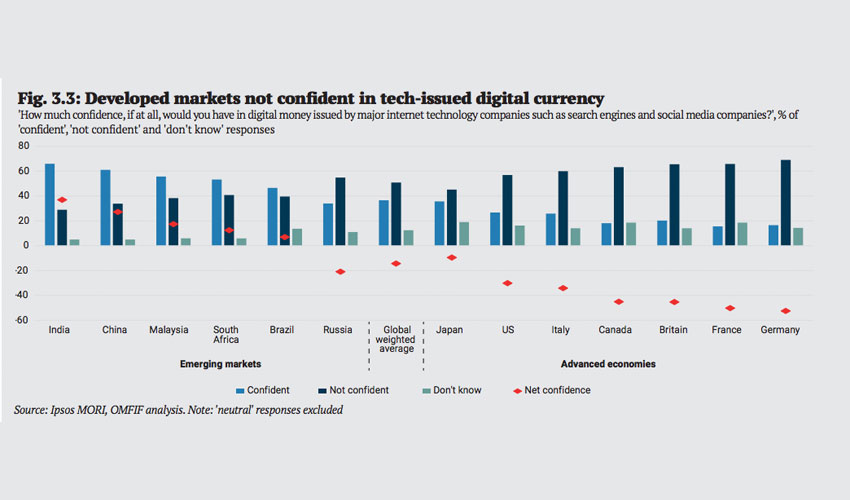

Last month, an Ipsos MORI/OMFIF survey found that India showed a strong inclination towards most kinds of digital currencies, whether issued by a central bank or a big tech company. The only other country that comes close in levels of interest is China, where crypto has been banned.

To date, most central banks have said that cryptocurrencies do not currently represent a threat because of their relatively small scale. They’re only concerned about Libra because of Facebook’s reach.

But most of these central banks don’t have populations that have the same degree of fascination with digital currencies as Indian citizens demonstrate.

An uncertain path

The RBI had previously sent out several circulars advising Indians to refrain from investing in crypto, citing high price volatility and a threat to the existing banking system. Another concern is anti-money laundering compliance.

At present, India does not have precise regulations in place for virtual currencies. In fact, a draft bill is proposed to ban crypto trading in India, but is yet to be tabled in the parliament.

Meanwhile, the RBI is exploring the issuance of a central bank digital currency (CBDC). The recently announced draft National Strategy on Blockchain also suggested a CBDC and a national blockchain.

Although the central bank is considering a digital currency of its own, the governor Shaktikanta Das is strongly opposed to the idea of a private digital currency. The same MORI/OMFIF survey showed India is the nation most keen on a CBDC, which is preferred to a private stablecoin.