On Friday, Dutch bank ING announced it has invested in the securities lending platform HQLAX. In November, the startup launched its collateral management solution built in conjunction with the Deutsche Börse, which to date, was the startup’s principal outside investor.

The first post production transactions in November were between Credit Suisse, UBS and Commerzbank.

HQLAX originally started as an incubator project at enterprise blockchain firm R3, and the initial prototype was done as an R3 Lab with five banks. One of the banks was ING and their team developed much of the prototype’s code. Following on from that was a live pilot in 2018 with ING and Credit Suisse, all prior to the collaboration with Deutsche Börse.

“The successful commercial launch of HQLAX is a big milestone for the implementation of blockchain in the securities lending market and proof that blockchain can bring tangible benefits to the industry,” said Mariana Gomez de la Villa, head of ING’s blockchain team.

“It’s rewarding to see that a project we’ve been working on for years, is now live.”

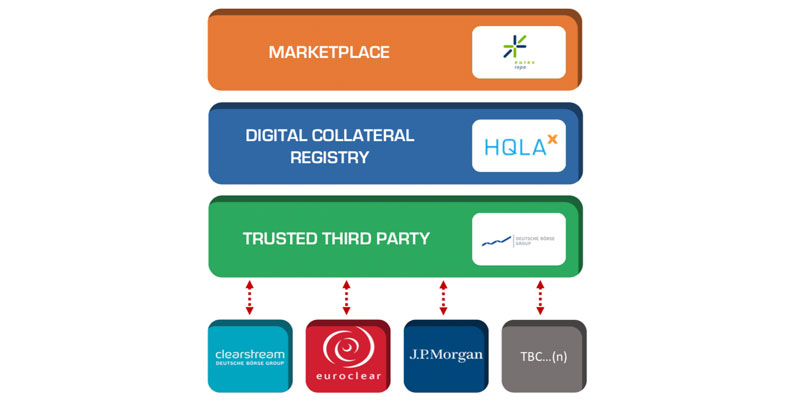

The platform enables banks to swap High-Quality Liquid Assets (HQLA) such as government securities, bonds and equities. Today banks around the world hold $13 trillion in HQLA. The collateral is held in custody, and when there’s a swap to upgrade or downgrade a portfolio, usually the custodians or collateral agents have to legally transfer ownership and move the assets. Instead, with HQLAX there’s a digital collateral record (DCR), and the transfer happens on-chain, thereby enabling intraday swaps.

It’s made possible by a Trusted Third Party owned by the Deutsche Börse that sits between the custodians (tri-party agent) and HQLAX. So the collateral stays with the original agent.

“HQLAX enables market participants to redistribute their collateral by exchanging the ownership of tokenised securities on Corda’s blockchain platform, which no longer requires the underlying securities to move across users. This removes settlement barriers and improves collateral fluidity, which in turn allows users to manage their liquidities easier, faster and more efficiently,” said Gomez de la Villa.

Current status and plans

HQLAX is in the process of onboarding at least 15 new members, including CIBC, Citi, Goldman Sachs and ING.

The tri-party agents involved at launch were Clearstream Banking and Euroclear Bank, and JP Morgan is expected to be live in the second quarter.

Asked about future plans, HQLAX CEO Guido Stroemer was keen to emphasize a focus on onboarding and the first application.

“We’re very sensitive not to try to do too much too early. Because it’s crucial for this very focused use case that we are delivering to the market that it’s used by the market,” explained Stroemer. “And then once we have this positive feedback loop where we have a critical mass of say ten to 15 clients actively using the platform on a day to day basis, then we will also have the critical mass of institutions at the table to help form our next steps in terms of product evolution.”

In the future, he sees potential for using digital collateral records (DCR) for pledging securities for OTC or centrally cleared derivatives exposures. Likewise, cash-on-ledger is interesting, and Stroemer said there are many ways to do that. We asked about the Utility Settlement Coin (USC) – the institutional currency backed by commercial bank deposits at central banks – because there has been talk about the two firms working together.

“Working with platforms such as Fnality and the USC (Utility Settlement Coin) is something that we’re open to. I think it would be a cool thing to be able to engage in a swap between a USC and a DCR, but at this stage, it’s not part of our product roadmap,” said Stroemer.

ING continues its enterprise blockchain push

For its part, ING is one of the most active banks in the blockchain sector. It invested in R3, the company behind the distributed ledger technology (DLT) Corda, and was the first to commit to multi-year enterprise blockchain licenses for Corda publicly. It’s also currently working on a digital asset custody solution. Unusually for a bank, it is developing core privacy technology, zero-knowledge proofs.

The bank is a participant in three out of four of the major trade finance platforms. It was one of the founders of the commodity trade finance platform komgo and is the biggest backer of TradeIX, which is the network operator of Marco Polo. More recently, it is one of eight founding banks behind the Contour Letter of Credit platform (formerly Voltron).

ING is particularly focused on the commodities sector, which is an attractive trade finance area. It’s part of the post-trade oil platform VAKT as well as Forcefield in metals.