Friss, the insurance fraud analytics company, recently conducted a technology survey amongst Property and Casualty insurers. So far only 2% of insurers are already using blockchain, with 21% considering starting a project in the next twelve months. 53% will not be starting an initiative in the next year, with the balance unsure.

Blockchain projects are live

The two percent figure is unsurprising. There are very few projects that are currently live. The ones that have launched include Axa’s flight insurance, the EY/Guardtime marine insurance platform, and Nationwide’s proof of insurance. MetLife has their gestational diabetes initiative in pilot phase. Plus a handful of startups are live such as Etherisc.

However, there is some lower profile activity, particularly where insurers have integrated with third-party blockchains. One example is trade finance insurance. Another is captive insurance which is by definition more private.

The major exception is the Far East, where Zhong An already processes billions of micro-insurance policies using blockchain.

Regarding the 21% of insurers with projects in the coming year, some of those might include members of the B3i and RiskBlock consortia as well as other known projects.

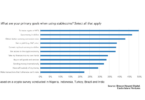

When asked which emerging technologies the insurers adopt, Blockchain came in sixth place. The order was Mobile Apps, Machine Learning, AI, Internet of Things, Robotics, and then blockchain.

Industry impact

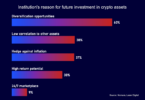

Concerning how blockchain could change the insurance industry, 56% believe it will simplify transactions. And 51% think it will transform the claims process. Reducing fraudulent claims scored 42% of the vote as did the use case of enabling smart contracts.

25% had no idea how blockchain could change the industry.

Unrelated to blockchain, the study found that 50% of insurers are actively deploying or piloting an insurtech solution.

The survey involved more than 170 insurance professionals and was conducted during the summer of 2018.