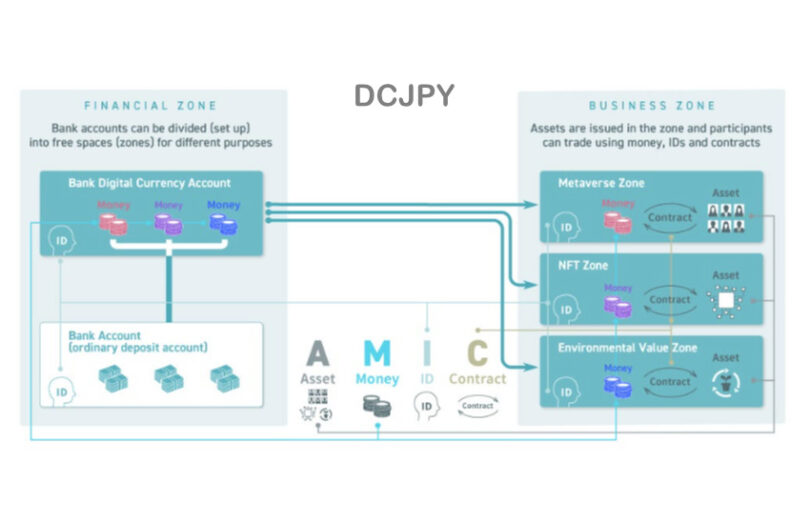

Today DeCurret, the operator of Japan’s tokenized deposit network DCJPY, announced plans to commercialize its offering in July 2024. Since 2020, a digital currency forum of over 100 Japanese institutions and enterprises have explored proofs of concept (PoCs) for various use cases. DeCurret raised $62 million in funding in 2021, including backing from MUFG, SMBC and SBI Holdings. Mizuho Bank and Japan Post are also forum participants, meaning Japan’s big four banks are involved.

However, the report on the DCJPY published today does not reference any corporate participants who have committed to launch on the network. It outlines several consumer oriented use cases, including retail in-store usage, to buy non fungible tokens, and consumer carbon credits. All of them have programmable money elements.

Separately, it announced the first concrete use case. It is partnering with the Internet Initiative Japan (IIJ) and GMO Aozora Net Bank, which will provide a digital currency. IIJ will join the Japan Electric Power Exchange (JEPX), allowing it to convert environmental values into digital tokens to be settled using DCJPY.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.