Today DeCurret, the operator of Japan’s tokenized deposit network DCJPY, announced plans to commercialize its offering in July 2024. Since 2020, a digital currency forum of over 100 Japanese institutions and enterprises have explored proofs of concept (PoCs) for various use cases. DeCurret raised $62 million in funding in 2021, including backing from MUFG, SMBC and SBI Holdings. Mizuho Bank and Japan Post are also forum participants, meaning Japan’s big four banks are involved.

However, the report on the DCJPY published today does not reference any corporate participants who have committed to launch on the network. It outlines several consumer oriented use cases, including retail in-store usage, to buy non fungible tokens, and consumer carbon credits. All of them have programmable money elements.

Separately, it announced the first concrete use case. It is partnering with the Internet Initiative Japan (IIJ) and GMO Aozora Net Bank, which will provide a digital currency. IIJ will join the Japan Electric Power Exchange (JEPX), allowing it to convert environmental values into digital tokens to be settled using DCJPY.

Work on DCJPY preceded Japan’s stablecoin legislation. And two of the three stablecoin options involve banks. Commercial banks can issue stablecoins backed by deposits. And trust banks can hold reserves on behalf of third party stablecoin issuers. In contrast, DCJPY creates a network of interoperable tokenized deposits.

DeCurret Director Eijiro Katsu (formerly deputy Finance Minister) spoke about the benefits of DCJPY. These include the “efficiency of business processes and the entire financial system with smart contracts, but it also enables businesses to utilize all data stored in the blockchain.” Hence the benefits include instant settlement, traceability and transparency, as well as supporting new business models.

DCJPY is about tokenization, not just digital currency

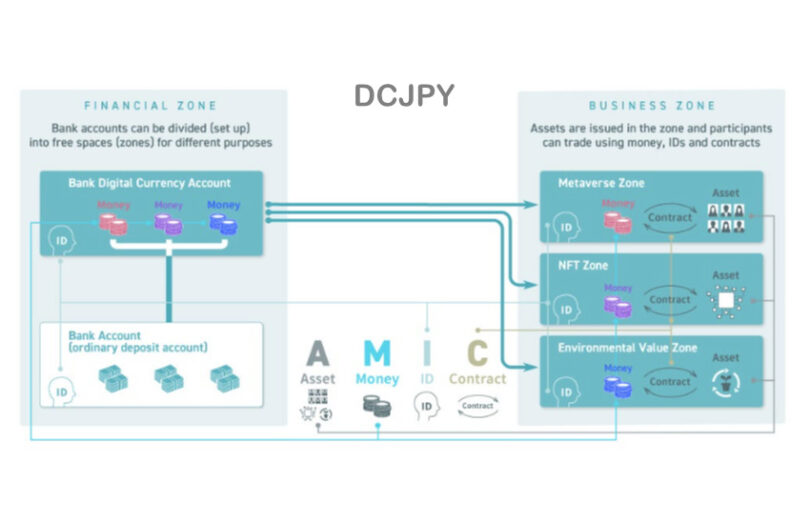

The DCJPY platform involves more than digital currencies. It envisages two zones as separate blockchain networks. One is a financial zone where banks issue deposit tokens and the money transfers take place. Business zones are separate DLT networks. For example, a metaverse zone, an NFT zone and an environmental value zone. It mentions security tokens but not a security token zone. That’s despite a heavy weight working group on the topic including Nomura, Daiwa Securities, JPX and the Osaka Digital Exchange.

Tokenized assets of any sort can be issued in the business zones. Smart contracts are executed and asset transfers take place on the business network. But not payments. The asset transfers are synchronized with payments in the financial zone, which is where banks mint, burn and transfer tokens using open banking APIs.

“DCJPY has been developed on the premise of a multi-bank system in which multiple banks use a common settlement infrastructure (Financial Zone),” said Toshihide Endo, Senior Advisor, Digital Currency Forum and former Commissioner at the Financial Services Agency. “Business entities using the Business Zone will be able to conduct transactions without being aware of their bank, creating an organic connection among the customers of each bank and expanding the network geometrically. “

Blockchain interoperability

The (Cosmos) IBC framework is used for blockchain interoperability. In turn, the business zones can link to external systems and networks. And the financial zone can be linked for payments on external networks.

Banks settle up amongst themselves bilaterally by netting all transfers once a day.

Business smart contracts involve two types. One is the user asset contract, which defines the nature of an asset. For example, that might be an NFT, a carbon credit or an insurance policy. Separately there is a money contract, which can trigger functions in the asset contract, such as a transfer function or burn the token.

However, some aspects were less clear in the paper. For example, are all business zones permissioned? Who operates the nodes? And how is the network governed? We hope to answer these issues soon.