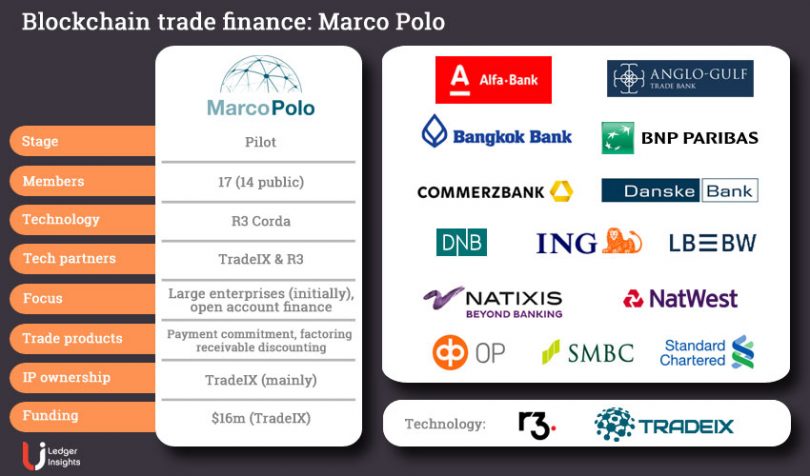

Marco Polo, the international blockchain trade finance network, has signed up 17 banks, with 14 made public so far. The network sets itself apart from others through a combined focus on open account financing with ERP integration and initially targeting large enterprises. It leverages R3’s Corda enterprise blockchain technology.

Along with R3, the primary technology provider is Irish startup

TradeIX founded by CEO Robert Barnes who previously co-founded PrimeRevenue. TradeIX isn’t merely a partner. It also built and licenses the “Marco Polo Platform” which forms a large part of the application software used on the Marco Polo network and customizable by each bank. That has the advantage of not requiring too steep an initial investment from banks.

Last year TradeIX raised a $16 million

Series A round, led by ING Ventures and including investment from BNP Paribas. Both banks are members of Marco Polo as well as the komgo and Voltron trade finance networks.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: Composite Ledger Insights, logos respective trademark owners