Mark Cuban’s venture capital firm Radical Investments has invested in CryptoSlam, an aggregator of non-fungible tokens (NFTs) collectibles data. If you’ve seen statistics about the total trades for any NFT platforms such as CryptoPunks or NBA Top Shot, the data has likely come from CryptoSlam or NonFungible.com. Aloomii Inc, Troon Technologies, and GeoAds LLC also participated in the funding round, although the amount raised was not disclosed.

CryptoSlam was founded as a website by Randy Wasigner in 2018 with the initial purpose of tracking Major League Baseball Champion’s collectibles. That was the MLB’s first foray into NFTs but has since been discontinued. Topps, the company that has licensed MLB collectible cards for years, announced the launch of MLB’s latest NFTs just last week. CryptoSlam grew and the first version of what it is today was launched at the beginning of 2019.

“As a life-long collector of sports cards and memorabilia, I was instantly drawn to the collectability of NFTs and the need to organize NFT data in a way that made sense to both collectors and those who saw NFTs as an investment opportunity,” said Wasigner. “After launching the first version of CryptoSlam in early 2019, I saw the enthusiastic response from fellow NFT collectors and knew we could be on to something special.”

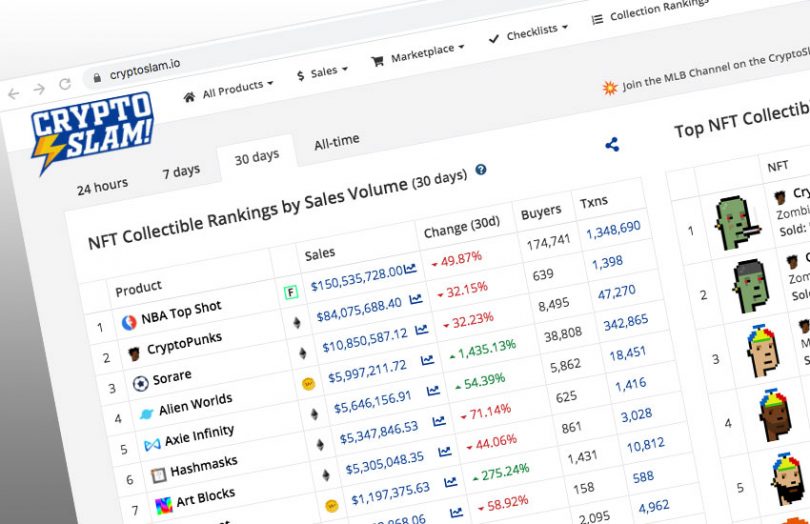

The project’s scope of work has increased significantly. It aggregates data on some of the most popular NFTs in sports and beyond, from NBA Top Shot moments, CryptoPunks, and Sorare collectibles. In total, 50 NFT projects are tracked on the platform, and it can collect project data from the Ethereum, WAX, and FLOW blockchains. The latter two specialize in supporting NFTs.

The idea is to gather all information about multiple NFTs projects in one single place, from cumulative sales, changes in price, number of buyers, and much more. The platform’s comprehensive overview on how NFTs are performing resembles stock overviews and market research analysis.

The similarities with stock analysis are not a coincidence. The recent growth in popularity in digital collectibles has led many people to see it as an investment opportunity, although prices are still very volatile.

One notable difference to stock analysis websites is that CryptoSlam is also targeted at collectors. A lot of the value in NFTs lies in their scarcity, and collectors are always looking to know how much their collectibles are worth and how they can further expand their selection. In this sense, despite CryptoSlam’s growth, it is likely it will still be attractive to members involved in NFT’s communities, which are often more enthusiastic about the digital collectible itself as opposed to its market value.

Mark Cuban’s investment came at the right time. The recent expansion in interest in NFTs and the launch of various news projects means that CryptoSlam needs to accelerate its growth and keep up with the industry to stay ahead of other NFTs data aggregators.

For Mr. Cuban, the investment further increases his involvement in the NFT industry. In late March, he participated in the Series A round of funding of NFT platform SuperRare, and he is part of NBA’s blockchain advisory board. The billionaire owner of the Dallas Mavericks also participated in the $23 million funding round of the NFT marketplace OpenSea.