The Hong Kong Monetary Authority (HKMA) announced that mBridge, a cross border central bank digital currency (CBDC) initiative, will launch a minimum viable product by mid-2024. Should the project prove a success, it could offer an alternative to Swift’s dominant payment infrastructure. And potentially set a precedent for further payment fragmentation across other regions.

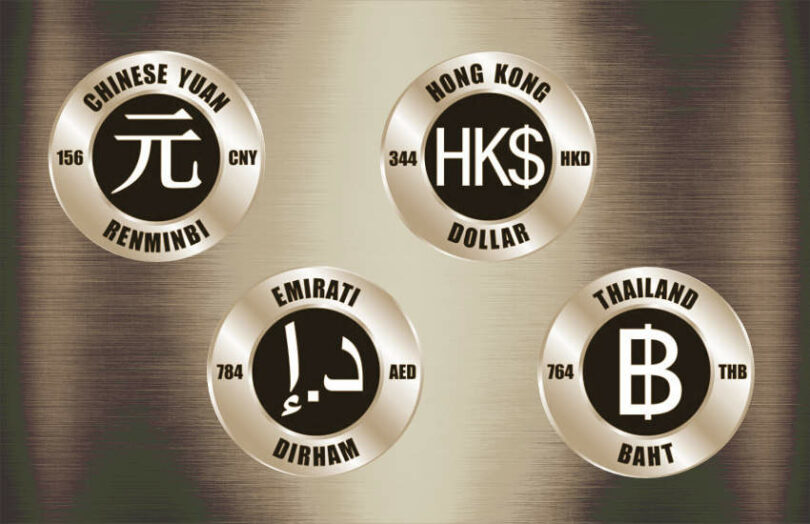

mBridge is a collaborative CBDC platform developed by the central banks of Hong Kong, China, Thailand and the United Arab Emirates. The project is coordinated through the Bank for International Settlements (BIS). The Chinese press recently reported participants will include Tencent, the owner of WeChat Pay and the WeChat app.

A further 20 central banks are receiving regular updates on the progress of the trials. The Saudi Arabian Monetary Authority (SAMA) recently expressed an interest in sharing experiences with the mBridge collaboration. However, it has yet to declare whether it plans to participate in the project.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.