The Hong Kong Monetary Authority (HKMA) announced that mBridge, a cross border central bank digital currency (CBDC) initiative, will launch a minimum viable product by mid-2024. Should the project prove a success, it could offer an alternative to Swift’s dominant payment infrastructure. And potentially set a precedent for further payment fragmentation across other regions.

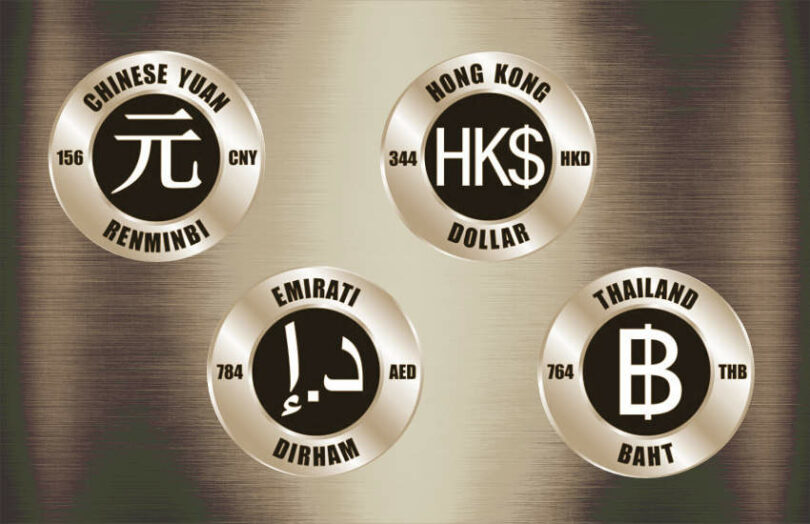

mBridge is a collaborative CBDC platform developed by the central banks of Hong Kong, China, Thailand and the United Arab Emirates. The project is coordinated through the Bank for International Settlements (BIS). The Chinese press recently reported participants will include Tencent, the owner of WeChat Pay and the WeChat app.

A further 20 central banks are receiving regular updates on the progress of the trials. The Saudi Arabian Monetary Authority (SAMA) recently expressed an interest in sharing experiences with the mBridge collaboration. However, it has yet to declare whether it plans to participate in the project.

eHKD retail CBDC trials progressing

While mBridge is a wholesale cross border CBDC project, the HKMA is also currently running eHKD retail CBDC trials. In a recent interview with the South China Morning Post, Eddie Yue, the CEO of the HKMA, explained the importance of exploring potential use cases. “It is still the beginning of the trial process,” he said. Continuing, “we have to find a use case that is better than the current retail payments. Because if you are not either safer, faster, or more convenient, then it will not be doable.”

The trials cover multiple use cases, with participation from 16 institutions. Last month HSBC issued eHKD to around 200 students and staff at the Hong Kong University of Science and Technology Business School to spend at five campus merchants.

Eddie Yue also acknowledged “some interesting use cases of e-HKD in the areas like programmable payments, and in new areas like tokenised deposits and tokenised assets”. One of the eHKD participants, Standard Chartered, began researching potential programmable features of a CBDC. Fubon Bank has also unveiled plans for a real estate tokenization pilot with Ripple, the blockchain and crypto firm associated with XRP Ledger.