Yesterday Mitsui & Co Digital Asset Management (Mitsui) announced it would launch an asset-backed security token next month through a collaboration with MUFG and SBI Securities. The issuance will likely be for Yen 760 million ($6.7m) over five years.

Mitsui will tokenize an interest in a warehouse, using MUFG’s blockchain platform Progmat and SBI Securities will offer the tokens to the public. MUFG is the trustee for the project. The property is part of Mirai, an investment company jointly managed by Mitsui Asset Management and Idera Capital.

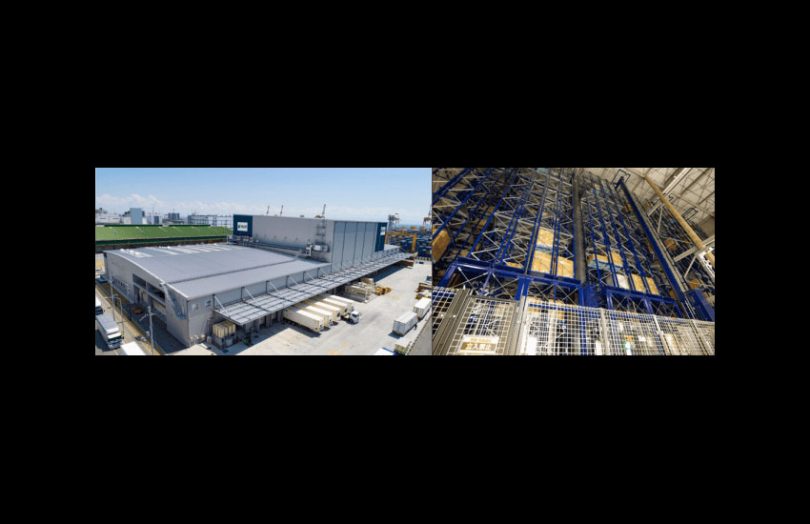

The warehouse is located on Rokko Island, a man-made island between Osaka and Kobe. The tenant is HAVI supply chain and the distribution center services a major restaurant chain and 600 stores in the Kansai area.

In August, Mitsui announced plans to tokenize real estate. Its digital asset division is working with blockchain startup LayerX, and hence we assumed it would use its own platform.

A month earlier MUFG shared plans to work with Nomura Securities and SBI Securities which would underwrite security token offerings. It issued a real estate security token with Kenedix as the asset manager.

Last month MUFG said that nine securities platforms had signed up to use the Progmat platform and 62 organizations are now involved in the Security Token Research Consortium. It outlined a roadmap that includes SBI’s Osaka Digital Exchange and enabling APIs for the Progmat platform so securities firms can easily connect. Progmat uses R3’s enterprise blockchain Corda.

Security tokens are progressing in Japan because of new regulations enacted in May 2020.