Earlier this month, the National Bank of Denmark Governor, Signe Krogstrup, delivered a speech arguing that the decline in the use of cash does not necessarily justify the issuance of a retail central bank digital currency (CBDC). This view is in sharp contrast to that of the European Central Bank (ECB), which says that a retail CBDC will be essential to ensure that consumers still directly own government-issued money as cash usage decreases.

In his speech, Mr. Krogstrup discussed some of the implications of the decline in the use of cash and the rise of digital payments for the central bank’s assessment of CBDCs.

The Governor noted the shift as an important trend at the core of the central bank mandates of monetary and financial stability. Indeed, between 2017 and 2021, the proportion of cash payments in Denmark decreased from 23% to 12%. By contrast, digital payments rose to almost 90%.

However, Mr. Krogstrup does not believe that “the decline in cash per se is a substantial risk to monetary and financial stability.” While low cash usage will continue to be monitored and studied, the Governor does not think that this reflects the sort of erosion of trust that would warrant a CBDC for private citizens and companies. He argues that commercial banks still have to hold central bank reserves, so cash is still at the core of the financial system.

Notably, this view is markedly different from the one espoused by the ECB, which sees the decline in the use of cash as a critical threat to government money. Last week, ECB president Christine Lagarde spoke about the need for a digital euro in the face of declining cash usage to ensure the integrity of money. She cited monetary sovereignty as a direct motivation behind the development of a digital euro. In the Eurozone, electronic payments are dominated by cards issued by U.S. platforms Visa and Mastercard. In contrast, Denmark has a domestic card system, with Dankort linked cards outnumbering international cards almost three to one. It has not adopted the euro as its currency.

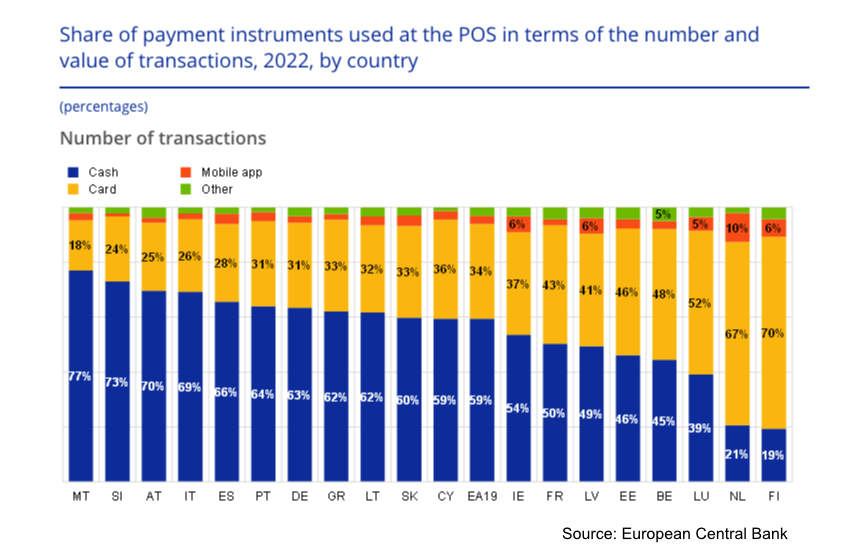

However, the European Union (of which Denmark is a part) still has an astonishingly high usage of cash compared to Nordic countries. As the chart below shows, cash makes up 59% of total payments at point of sale (POS) in the Eurozone. By contrast, the figure in Finland, Denmark, and Sweden is 19%, 12%, and 8%, respectively.

Overall, Governor Krogstrup sees the development of a wholesale CBDC as potentially necessary or desirable, for example, to enhance interoperability or cybersecurity for existing central bank reserves. Yet “the question of a retail CBDC goes far beyond technology,” he argues. “Its introduction would change the structure of the financial system and the respective roles and demarcation lines between commercial banks, central banks and other institutions in the provision of money.”