On Thursday, the Wall Street Journal (WSJ) reported that the player’s unions of Major League Baseball (MLB), the National Football League (NFL), and the National Basketball Association (NBA) had inked trading card deals with licensed sports apparel retailer Fanatics. Additionally, it claims the NBA and MLB leagues (but not the NFL) have also entered into collectibles agreements, citing sources.

Fanatics’ website says it’s “building the leading global digital sports platform.” It has a non-fungible token (NFT) joint venture, Candy Digital, with Mike Novogratz’s blockchain merchant bank Galaxy Digital as well as Gary Vaynerchuk. Before the latest news, Candy had already inked an NFT deal with MLB beyond conventional trading cards. The retailer is the major shareholder in Candy (more below), and it’s hard not to see the role of the NFT boom in this flurry of deals. Physical sports collectibles haven’t suddenly become more valuable. NBA Top Shot’s cumulative $689 million in NFT sales has something to do with reinvigorating the collectibles market.

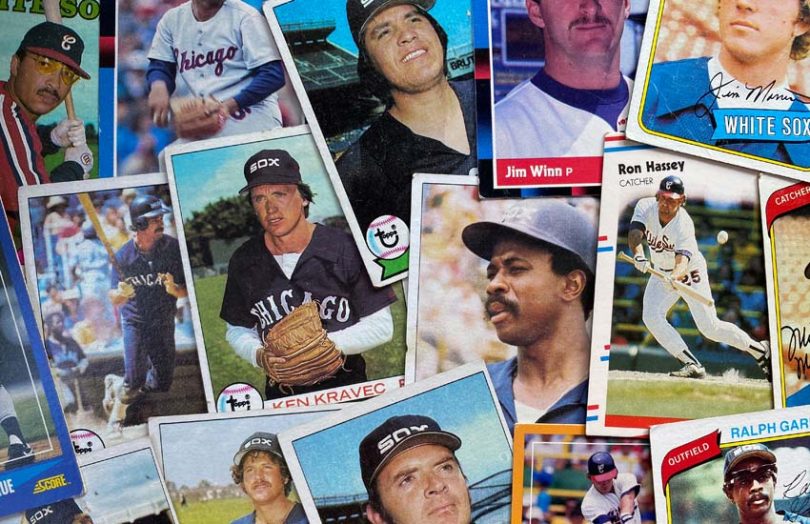

In an email to members, Tony Clark, executive director of the MLBPA, said that the player association’s deal is ten times the amount of anything it’s ever done previously. Last year the MLBPA earned $20.4 million from collectibles firm Topps.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.