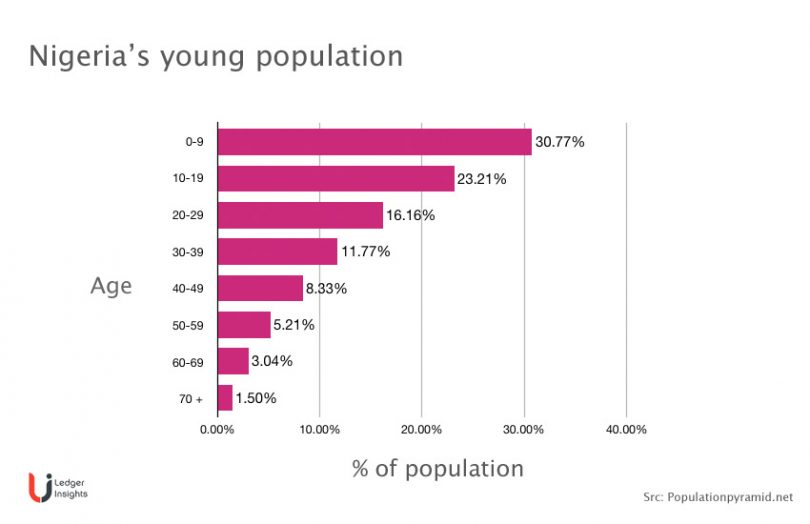

After some minor delays, today sees the launch of Nigeria’s eNaira pilot central bank digital currency (CBDC). Nigeria’s demographics and economy mean this pilot is particularly worth watching. The country has a population of 211 million, of which 62.8% are aged 24 or less, making a CBDC available to a largely digital native population.

Looking at the graph, it’s evident that a significant proportion of the population are minors. However, a substantial number of those youngsters are working. According to the International Labour Organization, 43% of Nigerian children aged between five and ten work.

It’s likely that the CBDC won’t be available to them initially. The pilot’s first phase is targeting only bank account holders, signing them up with Nigeria’s BVN bank identity. The next phase of the pilot will include the unbanked using Nigeria’s national identity NIN, which has now reached 60 million signups.

Based on the level of identity provided, a higher transaction limit for the eNaira is allowed. With a phone number and verified national identity, users can make payments of up to 50,000 Naira ($121) a day, rising to 200,000 ($484) for the lower level of bank-approved account.

Cryptocurrency ban and Naira devaluation

Despite a ban on cryptocurrencies in February, Nigeria ranks sixth in terms of cryptocurrency adoption by country, according to Chainalysis. One of the questions is whether an eNaira will have any impact on this.

Part of the answer may lie in the stability of the Naira currency. The central bank maintains a peg against the dollar but not other currencies. Since the onset of the pandemic, the currency has been devalued twice and is now worth 12.5% less.

Local newspaper, TheGuardian, argued that the cryptocurrency ban may have even raised the profile of cryptocurrencies in the country.

Another factor that may impact adoption is the motivation for launching the CBDC. Digitizing payments and financial inclusion are key drivers. But another goal is to increase tax receipts which could inhibit adoption by some groups.

CBDC design

The Central Bank of Nigeria has taken a platform approach to the CBDC’s design. It has a centralized blockchain ledger controlled by the central bank that logs all transactions and uses enterprise blockchain Hyperledger Fabric. Banks and payment service providers process retail payments and enable other payment services.

As part of the Central Bank of Nigeria’s inclusion goals, independent of the eNaira, it has targeted creating 500,000 agent outlets to serve rural communities. In the future, these agents will also support the eNaira.

Nigeria’s TheGuardian reported some pushback from banks concerned by disintermediation but did not quote any specific sources. The central bank previously acknowledged the risk and pointed to wallet limits which should mitigate some of the effects. However, commercial entities don’t have limits.

Meanwhile, the largest CBDC pilot is China’s. Elsewhere in Africa, Ghana announced a partnership for its e-Cedi with German central bank provider Giesecke+Devrient (G+D) Currency Technology. Bitt is Nigeria’s blockchain partner. And South Africa is also eyeing a retail CBDC.