In March, the Central Reserve Bank of Peru (BCRP) released a report presenting the key considerations for the adoption of a central bank digital currency (CBDC). The paper argued that a CBDC could help Peru deal with its low financial inclusion rate and increase its relatively weak pace of digital payment adoption while addressing the system’s general lack of interoperability. However, a number of structural issues suggest that a CBDC alone might not be enough to promote digital payments at scale.

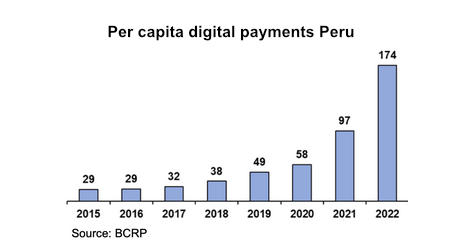

Like other developing countries, Peru is still a heavily cash-based economy, which is problematic for tax collection, high management costs, and financial inclusion. Although digital payments have grown significantly since the COVID-19 pandemic, cash remains the principal means of payment for the vast majority of the Peruvian population.

The problems that a CBDC could address

From a consumer perspective, the country’s cash affinity can be mainly explained by a general lack of financial inclusion. In 2021, only 49.7% of the adult population possessed a bank account, one of the lowest rates in Latin America. However, as the report indicates, even among this population, cash continues to dominate as the principal means of payment.

The paper cites high costs, lack of money, and distance to access points, among the main reasons for not having a bank account, but financial illiteracy and a large informal economy also seem to be important factors underlying low financial inclusion and digital payments adoption. A careful CBDC design could help reduce some of these barriers and provide the public with access to payment services that meet their needs.

Another difficulty in promoting digital payments is that limited smartphone and internet coverage in rural areas restricts people’s access to these services. However, emerging technologies and CBDCs are developing offline capabilities that could help to overcome these obstacles.

The fragmented nature of the Peruvian retail payment industry is also seen as a significant challenge, so the promise of higher interoperability among existing payment options is a key motivation behind issuing a CBDC.

However, the national payments system’s biggest challenge is merchants’ poor adoption of digital payments. Cash is anonymous and can sidestep tax reporting. There are also technology and literacy issues that speak of a deeper structural problem that a CBDC alone may not be able to address.

The potential advantages of a CBDC

Nonetheless, the BCRP argues that a CBDC would bring large benefits to the public, especially to the country’s unbanked population since it would offer an affordable and reliable means of payment. If appropriately designed, there would be many advantages to Peru’s payment ecosystem, such as:

- Fostering access and use of digital payment among unbanked people.

- Generating efficiency gains in payments markets by facilitating interoperability and incentivizing the adoption of digital payments.

- Enhancing monetary policy effectiveness by fostering financial inclusion.

- Contributing to preserving the achievements of lower dollarization in retail payments.

- Promoting financial innovation in a regulated environment, facilitating new agents’ operations in the payments market.

- Enabling programmable payments.

Meanwhile, Peru’s neighbor Brazil doesn’t see advantages in a retail CBDC because of its successful Pix mobile payment system. Instead, it supports the tokenization of bank deposits to enable programmable money backed by an interbank CBDC.