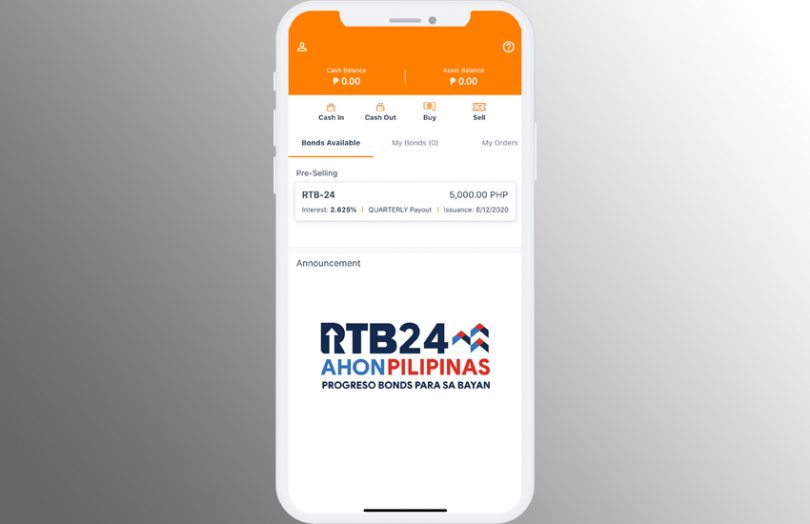

On Sunday, UnionBank launched an app “bonds.ph” that leverages blockchain and enables consumers to buy retail treasury bonds (RTBs) issued by the Philippines Bureau of the Treasury (BTr). This is the 24th RTB issue since 2001 to encourage financial literacy and for the unbanked to open a bank account and to save and invest.

But the new bond app doesn’t force buyers to open a bank account. They can deposit money through UnionBank and via a number of other apps, including PayMaya, which has a network 40,000 partners where users can deposit cash.

“The launch of Bonds.PH paves the way for all Filipinos, particularly the unbanked, to easily and affordably invest in the BTr’s newest retail treasury bond, RTB-24,” said Rosalia V. De Leon, National Treasurer, according to the Inquirer.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.