The research division of Ping An Insurance, the second-largest insurer in China, published a whitepaper on blockchain trade in conjunction with its fintech subsidiary OneConnect. The “Blockchain whitepaper for cross-border trade” sets out of a vision for how the flow of data in global trade can be integrated using multiple blockchains in a network of networks. Also know as blockchain interoperability.

“If existing and future Blockchain networks are able to integrate with each other in a framework of uniform standards, the total value that a converged network can create is much greater than the sum of the values created by the networks alone,” the paper states.

The document was published in February this year, shortly before OneConnect’s blockchain project for the Port of Tianjin went live (in April). OneConnect has been involved in numerous blockchain initiatives including as the developer behind the Hong Kong Monetary Authority’s trade finance platform eTradeConnect. Domestically, it has launched a supply chain finance network with hundreds of banks involved. Last month it inked a deal for blockchain development with Philippines Union Bank‘s fintech subsidiary UBX.

OneConnect is expected to conduct an IPO next month.

Cross border trade challenges

First, the document outlines how blockchain can address many of the challenges experienced in cross border trade. The issues are summed up well by calculations from the United Nations Commission on Trade and Development (UNCTAD) and UN/CEFACT. It’s estimated that on average a shipment involves 27 participants. There are usually around 40 kinds of documents, and when you include copies, it’s more like 400.

As children, we played the game Chain of Whispers and found it entertaining about how distorted the final message became. Translated into trade documents which are manually keyed into numerous systems, the resulting errors are not so amusing.

Then there’s the scale of the issue when you look purely at Chinese customs. In 2017 it handled 78.14 million customs declarations.

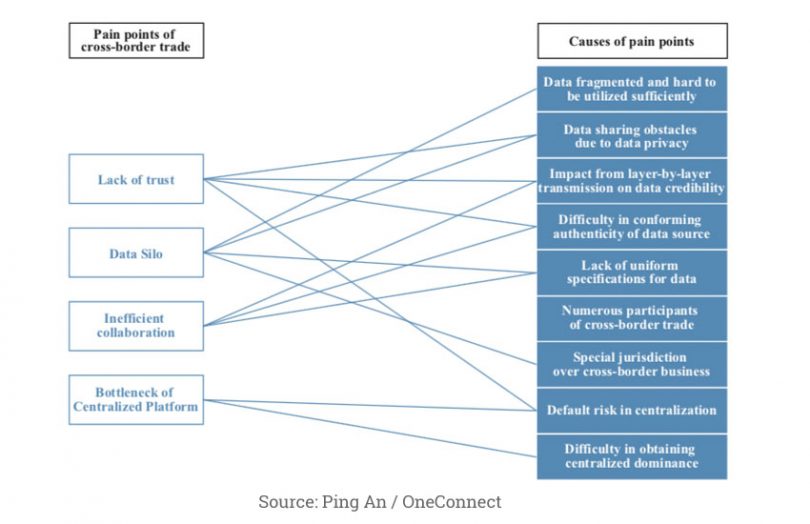

The problem boils down to data silos, lack of trust, and the inefficiencies in collaboration. Even when there aren’t trade wars, it would be challenging to have a centralized platform to address cross border trade issues.

Blockchain breaks the silos by connecting and sharing data. It enhances trust by making it almost tamper-proof because of the multiple copies. Plus authentication of identities leads to greater confidence about the source of digital documents, compared to the risk of manual forgeries. Automation enabled by smart contracts helps to address many of the inefficiencies in current inter-company collaboration.

The vision

Given the potential for a network of networks, how might that work? The paper states: “switch business processes from a concatenated manual propulsion mode to an automated, parallel business collaboration mode”. It sees the benefits as improved efficiencies as well as reduced operating costs and operational risks.

Not mentioned in the document is the Universal Trade Network (UTN) initiated by TradeIX and R3, which has very similar aims.

There are three requirements to fulfil the vision — the need for standards, open interfaces between networks, and connectivity between ledgers.

Starting with the open interfaces, it’s vital that APIs incorporate data standards.

It sees standard at three levels: international, regional and company-specific. And the standards don’t just relate to structured data like invoices and orders where standards already exist. There’s also a need to address other areas like IoT which will play a pivotal role in the automation of trade. The paper gives a good overview of the power of combining blockchain with IoT, Big Data and AI.

The three levels of standards also feed into cross ledger connectivity. It envisions the potential for private ledgers, regional ledgers and international ledgers, and they all need to communicate.

But it also sees ledgers categorized by business segments. For example, orders and commercial invoices might be on a trade finance ledger, waybills and shipping data on a logistics ledger. And licenses and customs declarations might be on another ledger.

Security of data is a challenge because some countries – China is one example – have restrictions on international data transfer. It suggests a need for standards and regulations relating to cross-border data. This would address confidentiality, integrity, usability, controllability and non-repudiation.

It suggests that an international organization such as UN/CEFACT might take on the role to address any centralized aspects such as access to consortium chains or adjusting consensus mechanisms.

The whitepaper concludes by highlighting the limitations of individual blockchains: “A system initiated by a participant or a consortium is usually relatively closed and difficult to attract participants of the same volume as the system’s dominant party, resulting in the fragmentation of the overall data flow and the inability to realize the full values of the data.”

“Therefore, it is extremely important to facilitate the global cross-border trade by realizing the connectivity between Blockchain systems and the connectivity between Blockchain systems and traditional non-Blockchain systems.”