Last week, Japanese bank SBI Holdings released

details of 13 banks who have invested in MoneyTap, SBI’s blockchain based transfer app. MoneyTap was

launched in 2018 as a project from SBI Ripple Asia, a joint venture between SBI (60%) and Ripple (40%) claiming it had 60 Japanese banks signed up.n

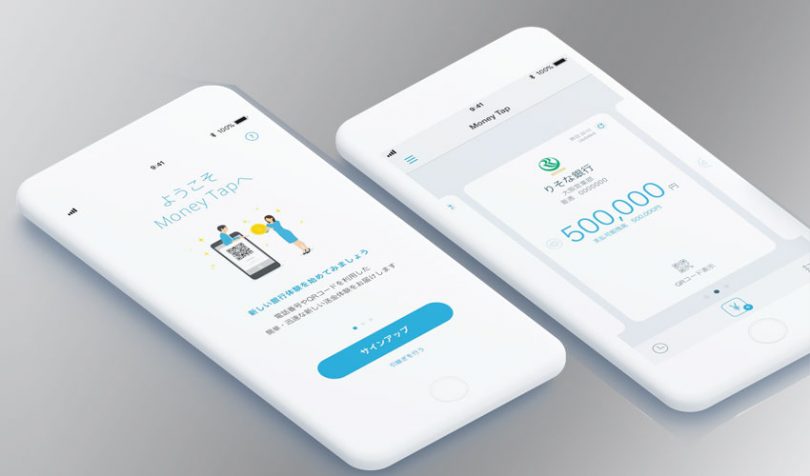

The app provides a secure platform for money transfer based on distributed ledger technology (DLT). Payments can be made either within Japan or internationally. The system uses Ripple’s xCurrent protocol, which is the messaging part of Ripple’s technology.

In Japan, conventional bank transfers can only be made during banking hours. MoneyTap’s 24/7 availability is a key advantage in the market. It also uses QR codes and fingerprint biometrics to combine secure payments and positive user experience.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: SBI Ripple Asia